PulseChain Price Prediction

Methods To Predict The Price Of PulseChain (PLS)

Getting Started -

PulseChain (PLS) Price Prediction

PulseChain experiences high volatility just like any other cryptocurrency which is why it’s useful to be able to predict the price of PLS and trade accordingly. Today we’ll be looking at how you can use methods such as technical and fundamental analysis to formulate your own PulseChain price prediction.

Let’s take a look at some commons questions regarding the price of PulseChain (PLS)

- PulseChain Price Prediction For 2023

- PulseChain Price Prediction For 2024

- PulseChain Price Prediction For 2025

- PulseChain Price Prediction For 2026

- PulseChain Price Prediction For 2027

- PulseChain Price Prediction For 2028

- PulseChain Price Prediction For 2029

- PulseChain Price Prediction For 2030

- Is PulseChain (PLS) A Good Investment?

- PulseChain Price Prediction Through Technical Analysis

- PulseChain Price Prediction Through Fundamental Analysis

If you’re unfamiliar with PulseChain (PLS), follow the links below to learn more.

Analyzing Price -

Analyzing The Price Of PulseChain (PLS)

One of the simplest methods to predict the future price of a cryptocurrency like PulseChain (PLS) is by looking at prior price history on a chart. Through the use of common technical analysis techniques such as identifying horizontal support and resistance levels, calculating moving averages and calling on indicators to signal strength or weakness in the market we can summarize a PLS price prediction from the tools that are freely available online.

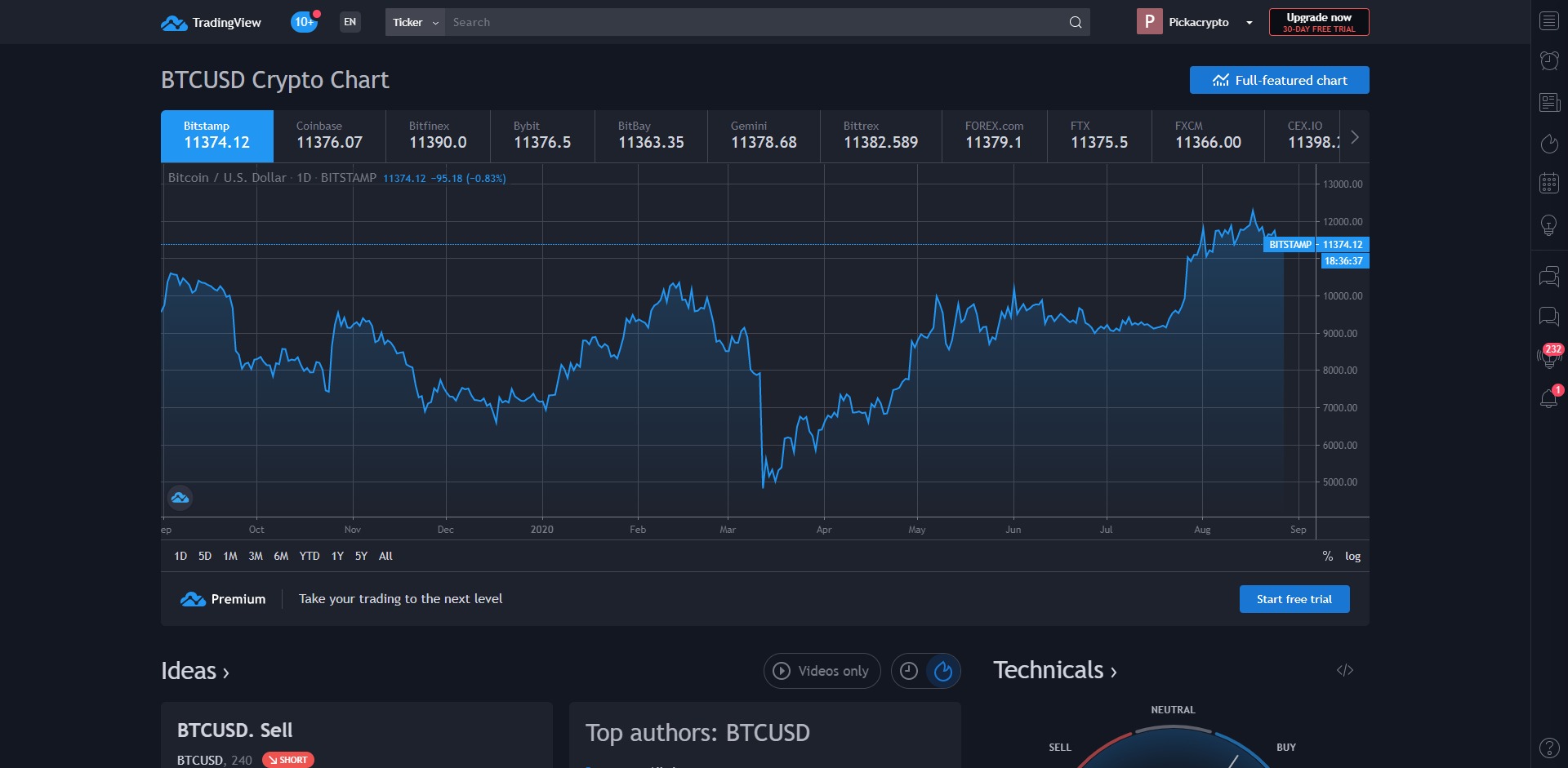

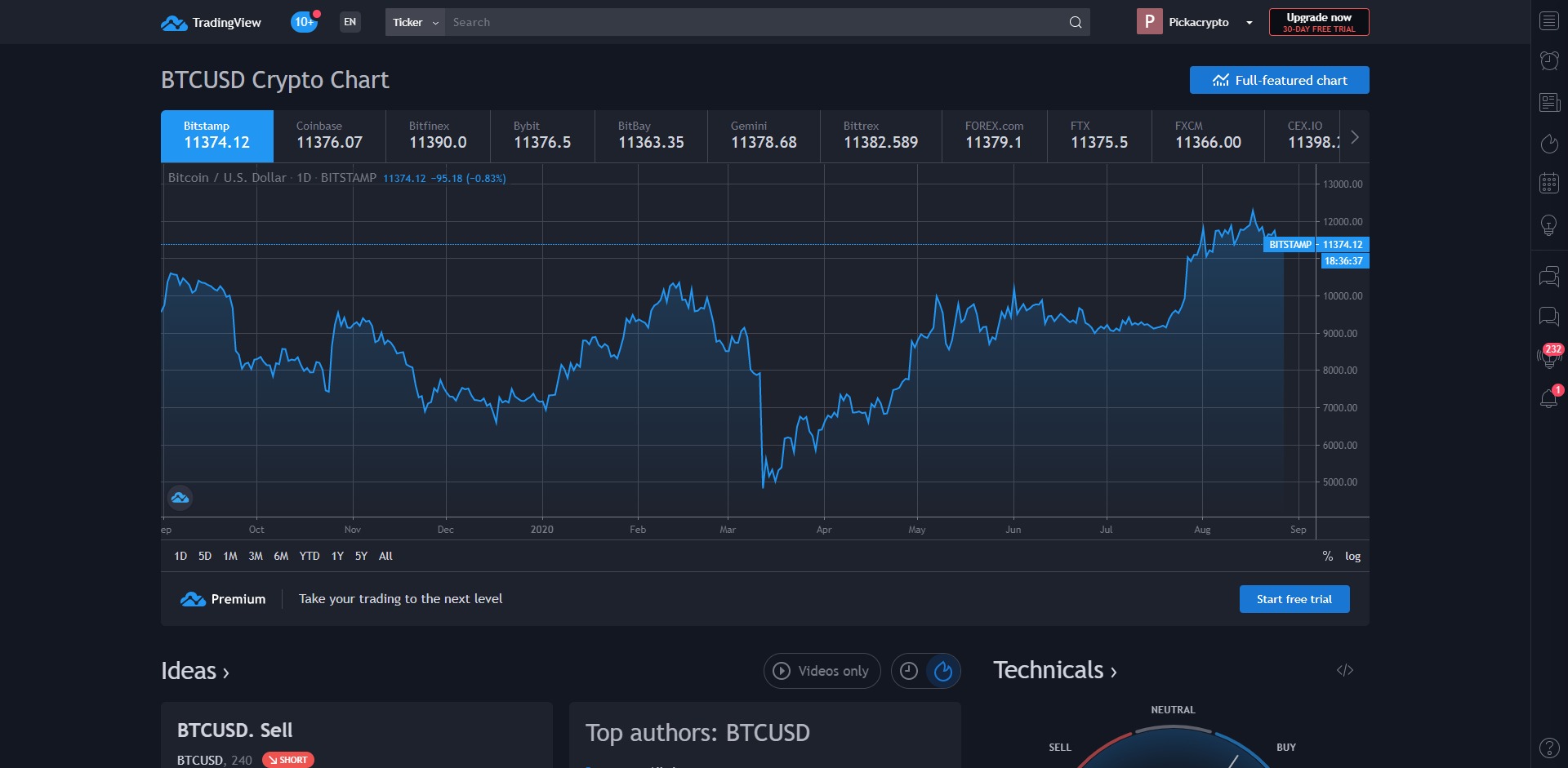

The large majority of popular cryptocurrencies are available to chart and analyze on TradingView. TradingView integrates with popular exchanges like Binance, Huobi, ByBit, Kucoin and many more to offer real-time price data on a wide range of Altcoins such as PulseChain (PLS).

Analyzing Price -

Analyzing The Price Of PulseChain (PLS)

One of the simplest methods to predict the future price of a cryptocurrency like PulseChain (PLS) is by looking at prior price history on a chart. Through the use of common technical analysis techniques such as identifying horizontal support and resistance levels, calculating moving averages and calling on indicators to signal strength or weakness in the market we can summarize a PLS price prediction from the tools that are freely available online.

The large majority of popular cryptocurrencies are available to chart and analyze on TradingView. TradingView integrates with popular exchanges like Binance, Huobi, ByBit, Kucoin and many more to offer real-time price data on a wide range of Altcoins such as PulseChain (PLS).

Technical Analysis -

Identifying Support & Resistance Levels

Identifying levels of support and resistance are often all it takes to start creating a PLS price prediction, at least in the short to mid-term. Horizontal resistance levels can be identified by counting the amount of times a price is tested and rejected on an attempt upwards. Horizontal support levels can be identified by counting the amount of times a a price tests and bounces from a particular price on the way down. Predicting the price of PLS can also be useful for determining sell targets if you’re already holding PLS and wondering where to sell for the highest profit.

In the following chart we can see that price has had many interactions with the areas marked in yellow, specifically at points marked by green arrows. Seeing as price has interacted with these marked areas many times in the past, Traders can use these areas in which to setup buy or sell orders depending on what they believe will happen. From this data you may be able to create your own PLS price prediction and trade accordingly.

Technical Analysis -

Using Moving Averages

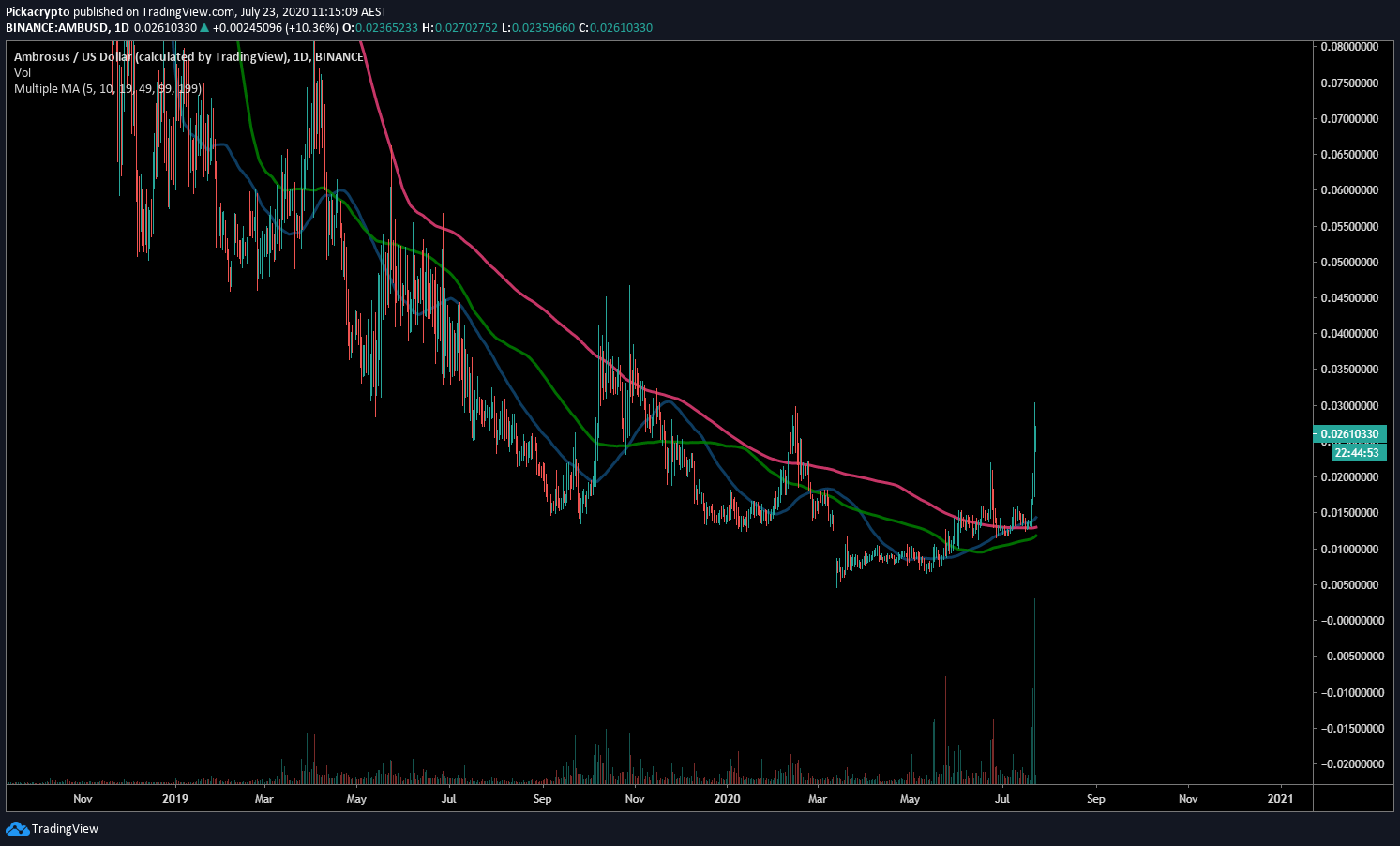

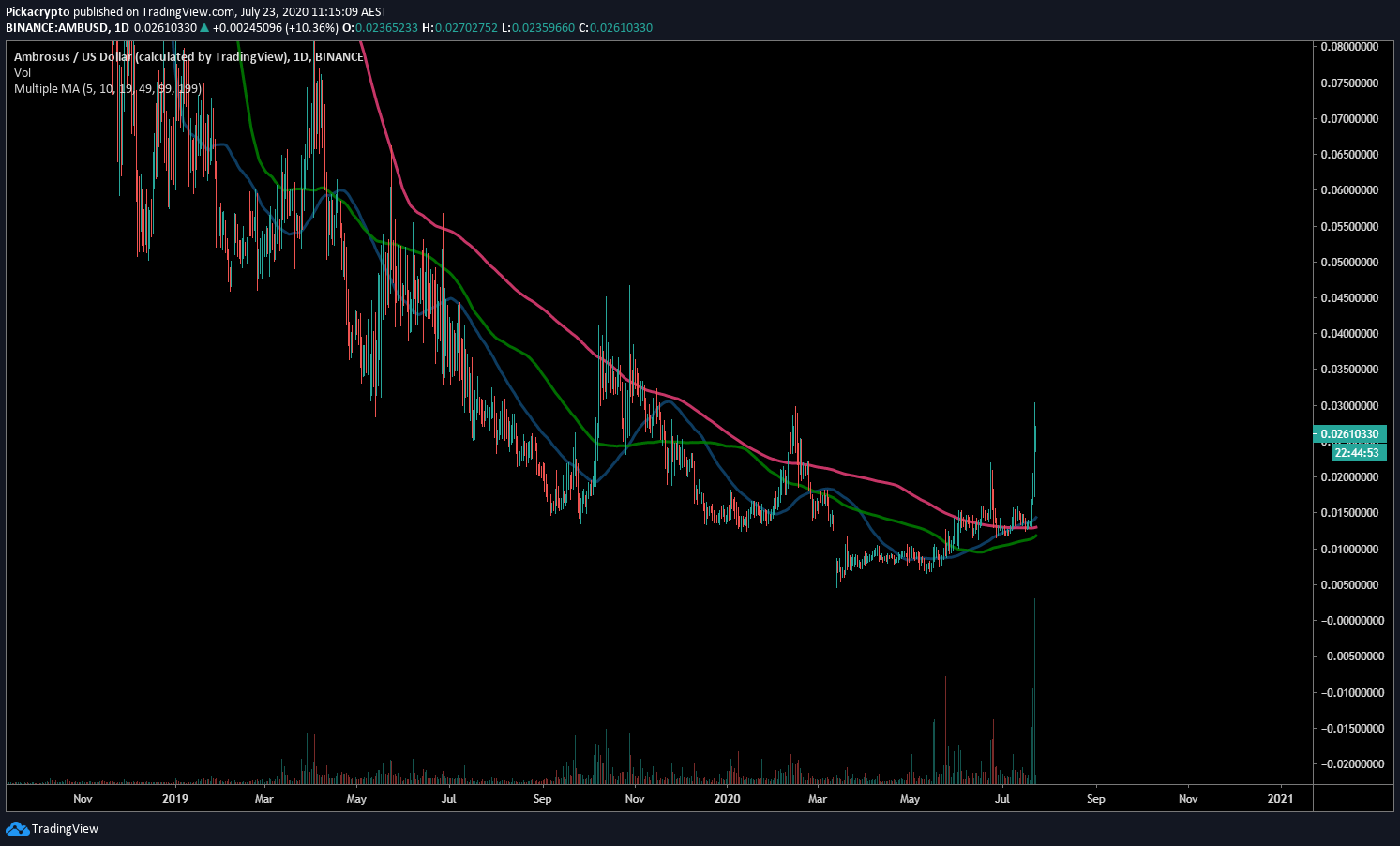

Creating a PulseChain price prediction can also involve Moving Averages or “MA’s”. Moving averages are used by many Traders to assess momentum and potential levels where price is likely to bounce from a downtrend or start slowing down after an uptrend. With the use of several important moving averages such as the 20, 50, 100 and 200, Traders can get a good idea of when to buy PulseChain (PLS) and when to sell for profit.

In the following image we can see that price has had several interactions with the 1D 200MA which is represented by the pink line running through the chart. From this we can assume that this line will remain important in determining the price of an asset like PulseChain and creating a short, mid and even long term PulseChain price prediction.

For long term investing or trading, look at moving averages on the daily or weekly charts for important levels in which to form your PulseChain (PLS) price prediction.

Technical Analysis -

Using Moving Averages

Creating a PulseChain price prediction can also involve Moving Averages or “MA’s”. Moving averages are used by many Traders to assess momentum and potential levels where price is likely to bounce from a downtrend or start slowing down after an uptrend. With the use of several important moving averages such as the 20, 50, 100 and 200, Traders can get a good idea of when to buy PulseChain (PLS) and when to sell for profit.

In the following image we can see that price has had several interactions with the 1D 200MA which is represented by the pink line running through the chart. From this we can assume that this line will remain important in determining the price of an asset like PulseChain and creating a short, mid and even long term PulseChain price prediction.

For long term investing or trading, look at moving averages on the daily or weekly charts for important levels in which to form your PulseChain (PLS) price prediction.

Technical Analysis -

Utilizing Indicators

Indicators can assist Traders in making a prediction on whether the price of PulseChain (PLS) will go up or down. Indicators take into account various factors such as time, volume, momentum and many more to indicate whether a cryptocurrency like PulseChain (PLS) may rise or fall. Although they’re unable to predict the price of PLS, they’re able to indicate trends and strength

In the following image we can see that the RSI (Relative Strength Index) Indicator which is used by a large majority of Traders is located at the bottom of the chart. The areas above and below the dotted lines indicate whether a coin like PulseChain (PLS) is overbought or oversold. The RSI takes into account prior price action and volume to indicate whether there is a shift from buying to selling or selling to buying.

We’ve highlighted four different occasions where a coin has been overbought or oversold which quickly resulted in a change in overall trend.

Fundamental Analysis -

Assessing Strengths & Weaknesses

Another way to make a PulseChain (PLS) price prediction is by assessing what the project has accomplished or plans to accomplish in the near future. Keeping up to date with PulseChain (PLS) news and planning the buy or sell PulseChain (PLS) around key events is a method long term Traders use consistently.

While technical analysis may assist Traders in deciding when to buy or sell PulseChain (PLS), fundamental analysis can often help forecast future PLS price based on the knowledge of upcoming notable events or breaking news which may have an immediate and unexpected affect on price, regardless of what the charts show.

Keeping up to date with important PulseChain (PLS) news will give Traders an edge where technical analysis falls short.

Fundamental Analysis -

Assessing Strengths & Weaknesses

Another way to make a PulseChain (PLS) price prediction is by assessing what the project has accomplished or plans to accomplish in the near future. Keeping up to date with PulseChain (PLS) news and planning the buy or sell PulseChain (PLS) around key events is a method long term Traders use consistently.

While technical analysis may assist Traders in deciding when to buy or sell PulseChain (PLS), fundamental analysis can often help forecast future PLS price based on the knowledge of upcoming notable events or breaking news which may have an immediate and unexpected affect on price, regardless of what the charts show.

Keeping up to date with important PulseChain (PLS) news will give Traders an edge where technical analysis falls short.

PulseChain In 2023 -

PulseChain (PLS) Price Prediction For 2023

Using support/resistance, trendlines, moving averages and simple indicators like the RSI, you can create a reasonably accurate PulseChain price prediction for 3, 6 and 12 months ahead of time. We think that price could reach somewhere around the $0.0134 to $0.035 USD range in the next few months.

Fundamental analysis should be a part of your analysis when creating your own PulseChain price prediction. Researching what the PulseChain Team is doing in the next few months can help you determine whether or not an investment will be profitable after certain events, roadmap goals or milestones are met. Technical analysis holds more weight against fundamental analysis in determining short term PLS price movements but it’s important to acknowledge upcoming events in the coming weeks and months.

Through current trends, Investor sentiment and the overall direction of the cryptocurrency market, we think PulseChain (PLS) has a good chance of visiting prices of around $0.0134 to $0.035 USD in 2023 as long as the trend continues and the PulseChain Team continues to work on their products and partnerships.

PulseChain In 2024 - 2025 -

PulseChain Price Prediction For 2024 - 2025

From 2024 to 2025 we think the price of PLS to visit the $0.045 to $0.065 area as the Team continues to develop their products and those products receive adoption from the target audience. This PLS price prediction is based on several data sets and predictive modelling which assumes the current long term trend driving the price of PLS continues in an upwards direction with no major setbacks.

Fundamental analysis of PulseChain is crucial when predicting the price of the PLS token in the long term. Long term trends determined by technical analysis from years of historic price data will assist in predicting the years ahead, but fundamental analysis is key. You’ll need to keep track of newsletters, social media, upcoming events, overall Investor sentiment and market conditions as they change over time to determine when to buy or sell at the right time. Creating a PulseChain price prediction from collated data is an overall useful step in determining whether a long term investment is expected to be profitable.

Using prior price data, predictive modelling and Investor sentiment scraped from various sources online, a PulseChain (PLS) price prediction of around $0.045 to $0.065 USD is what our data shows could be possible in 2024-2025 given the fundamentals of PulseChain and prior price data of the PLS token.

PulseChain Price Prediction For 2024 - 2025

PLS Price Prediction For 2024 - 2025

From 2024 to 2025 we think the price of PLS to visit the $0.045 to $0.065 area as the Team continues to develop their products and those products receive adoption from the target audience. This PLS price prediction is based on several data sets and predictive modelling which assumes the current long term trend driving the price of PLS continues in an upwards direction with no major setbacks.

Fundamental analysis of PulseChain is crucial when predicting the price of the PLS token in the long term. Long term trends determined by technical analysis from years of historic price data will assist in predicting the years ahead, but fundamental analysis is key. You’ll need to keep track of newsletters, social media, upcoming events, overall Investor sentiment and market conditions as they change over time to determine when to buy or sell at the right time. Creating a PulseChain price prediction from collated data is an overall useful step in determining whether a long term investment is expected to be profitable.

Using prior price data, predictive modelling and Investor sentiment scraped from various sources online, a PulseChain (PLS) price prediction of around $0.045 to $0.065 USD is what our data shows could be possible in 2024-2025 given the fundamentals of PulseChain and prior price data of the PLS token.

PulseChain In 2026 - 2030 -

PulseChain (PLS) Price Prediction For 2026 - 2030

In order to predict long-term prices we need to expect wider ranges in price targets. Based on previous performance and token metrics such as circulating supply, emissions and product market fit, we can make rough guesses on PulseChain price predictions for 2026, 2027, 2028, 2029 and 2030.

PulseChain price prediction for 2026: $0.06279999999999999 to $0.079 USD

PulseChain price prediction for 2027: $0.089 to $0.104 USD

PulseChain price prediction for 2028: $0.119 to $0.134 USD

PulseChain price prediction for 2029: $0.151 to $0.172 USD

PulseChain price prediction for 2030: $0.195 to $0.221 USD

Note: the above predictions may be based on only 1-2 years worth of data and therefore could end up being inaccurate after some time due to a large number of factors. These estimates are not to be taken as financial advice.

PulseChain (PLS) Price Prediction -

Is PulseChain (PLS) A Good Investment?

When deciding on if PulseChain (PLS) is a good investment for you, taking into account risk and reward is crucial. We can predict the price of PLS both in the short term and long term, but expectations need to be reasonable for each. Long term we think PLS will appreciate based on the fundamentals of the PulseChain project and the progress the Team is making towards their roadmap goals and milestones.

By using Technical Analysis we are able to predict what the price of PLS may be in the short term and calculate our investment sizes accordingly. Using horizontal resistance and support levels, moving averages, various indicators and other techniques, you can make an educated price prediction on whether the price will go up or down in the next few days, weeks and months.

The cryptocurrency market is extremely volatile and hard to predict in the long term so researching the fundamentals and progress of PulseChain is an essential task before deciding to invest any amount of funds for the long term with the aim of holding for months or years. When analyzing the price of PulseChain to form a price prediction for the short or long term, taking both technical and fundamental analysis into account is essential.

PulseChain (PLS) Price Prediction -

Is PulseChain (PLS) A Good Investment?

When deciding on if PulseChain (PLS) is a good investment for you, taking into account risk and reward is crucial. We can predict the price of PLS both in the short term and long term, but expectations need to be reasonable for each. Long term we think PLS will appreciate based on the fundamentals of the PulseChain project and the progress the Team is making towards their roadmap goals and milestones.

By using Technical Analysis we are able to predict what the price of PLS may be in the short term and calculate our investment sizes accordingly. Using horizontal resistance and support levels, moving averages, various indicators and other techniques, you can make an educated price prediction on whether the price will go up or down in the next few days, weeks and months.

The cryptocurrency market is extremely volatile and hard to predict in the long term so researching the fundamentals and progress of PulseChain is an essential task before deciding to invest any amount of funds for the long term with the aim of holding for months or years. When analyzing the price of PulseChain to form a price prediction for the short or long term, taking both technical and fundamental analysis into account is essential.