All metrics & charts included in this article are fixed at the time of posting. These will not be updated

1 | Bitcoin (BTC / USDT)

The Bears are excited

Bullish Scenario

- The bulls want to see a breach above the $10k-$10.2k area and a decent close on a higher timeframe such as a 4hr, 12hr or even better, a 1D close.

- If price breaches above $10.2k and holds we can expect either consolidation at that level or a bounce up towards the high $10k range. There is a ton of chop around the high $10k range so don’t expect it to just rocket through this area.

Overview

- BTC still looking pretty weak. There’s an argument to be made that the decrease in volume is bullish with the theory that sellers aren’t interested in selling at these levels anymore.

- Similar to last week, We’ll be sitting this week out until either the bears or the bulls settle this and we break one of the trends/supports. Let everyone else lead the way before we join in.

- The Bulls really just want to crack above that $10k area again and hold some ground. It seems a both Bulls and Bears are just waiting to see what happens. The market as a whole is lacking this week. BTC needs to make a decision first.

Bearish Scenario

- The Bears want price to break through that $9.2k support with a dump under $9k. This would be very bad for the Bulls but if you’re in the market for some cheap BTC, the $8k area is an excellent buying opportunity.

- No other comments here really. BTC needs to make a decision in the next few days leading into the monthly close. We’ll take a look again next week with a definite bias as opposed to our neutral one now.

2 | Ripple (XRP / BTC)

Easy invalidation levels. Easy trade.

Bullish Scenario

- The bulls really need a break up to the 3400 area followed by a retest of the current support turned resistance. Although there are some very clear invalidation levels provided, BTC is about to make a decently sized move which could cause a fakeout either way. Wait for a 4hr, 12hr or even better, a 1D close before assuming anything.

- Some short term targets around 3500 and 3800+ make this a very nice risk/reward play. You could safely trade this with a 2% stop loss and rake in a tidy 10% profit if all goes to plan

Overview

- XRP provides some very clear invalidation levels and offers both Bears and Bulls an opportunity here seeing as majority of decent margin trading platforms (e.g ByBit) have XRP available to long/short.

- Breakout above the previous support turned resistance and the Bulls are in charge. Dip outside of the current uptrend and the Bears take over.

Bearish Scenario

- Bears have a pretty obvious short opportunity here. Break down from the trendline shown on the chart above and there’s a great risk/reward short available.

- If XRP turns bullish, reference the TP zones set out in the chart above and prepare some shorts around those areas if you wish.

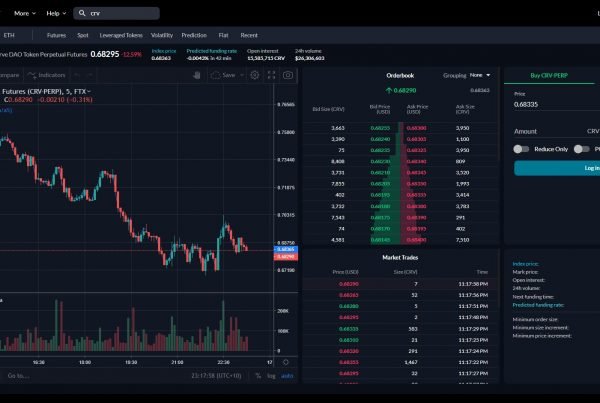

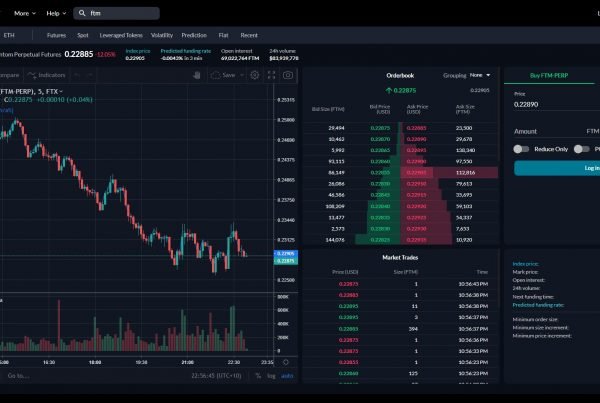

3 | Fantom (FTM / BTC)

Some of the nicest price action this week

Bullish Scenario

- Very bullish structure. This chart was drawn up a few days ago and our buy areas are still waiting. We’re expecting BTC to make a decent move which will hopefully bring FTM down to our buy areas. These setups with very clean price action can be the most profitable for day traders as well as swing traders who are looking to build a longer term position.

- In terms of risk/reward, it’s not too special if you regularly trade with tight stops. You’re looking to accept a 10% risk here which is why it’s wise to either scale in slowly or if you’re quick, wait for a volume fueled bounce that confirms a change in direction.

Overview

- This price action reminds us of when Alts reversed and ran hard throughout January to March 2019. Very clean support/resistance levels being respected, just nice trading opportunities all around.

- FTM needs BTC to chill out for a while. Unfortunately it looks like BTC is very close to making a violent move and we’ll see some disruption to this price action. At it’s current level, a decent dip caused by BTC might be enough to get FTM down in our buy areas. Very attractive trade.

Bearish Scenario

- We’ve seen this setup time and time again and it’s usually very bullish. The Bears are really just relying on BTC to make a big move which will shake up the vast majority of Altcoins.

- It would be extremely surprising to see this structure break down completely or retrace under 200 sats. The Bears don’t have much control here yet.

4 | Basic Attention Token (BAT / BTC)

Something about a Wyckoff

Bullish Scenario

- The Bulls want to grab some more BAT somewhere between 2400 and 2600. Seeing as BTC is due for a move, it’s smarter to scale in here and below rather than buying your entire position right away when there’s most likely going to be a better opportunity in the near future.

- If you’re a swing trader, you should really be using this structure as a “buy the dip” opportunity. Seeing as the current structure screams accumulation, building a mid/long term position here provides a high risk/reward. If you’re day trading you can expect a 10%+ play here in the next few days if all goes to plan.

Overview

- One of the best looking Altcoins out there this week. Classic Wyckoff Accumulation Phase playing out and coming to an end. With BTC about to make a move it’s probably not a bad idea to scale some bids down to the 2400 area. We don’t want to see BAT make a move under 2300.

- Similar to FTM this week, we’ve seen this structure time and time again when an Altcoin goes through it’s short-term accumulation phase prior to reversal. Slightly choppier than FTM but still provides some clear support/resistance levels for loading up or taking profit.

Bearish Scenario

- The Bears really just want to push BAT down to the 2400 level and below before loading up. Bulls would start getting nervous around this area in fear that the previous support could break down.

- Seeing as BAT is so close to its all-time-low, there isn’t much sense being too bearish here. There’s far more opportunity in being bullish and scaling in around these levels.

5 | Matic Network (MATIC / BTC)

Decision time

Bullish Scenario

- MATIC began it’s run to 500+ sats from around the 50 sat mark. Accumulating around the 100+ area is from our point of view, a great opportunity.

- Bulls ultimately want to see a break of the trendline and they won’t need to wait long. With BTC about to make a move, you can limit your risk by waiting for a break of the trendline with a good amount of volume behind it. Close + retest type play.

- If you really want to play it safe, wait for a 4hr, 12hr or even a 1D close about the trendline.

Overview

- It’s decision time for MATIC. We’re leaning bullish but we’re ready for BTC to cause some violent fakeouts pretty shortly. When MATIC first ran hard from around 50 sats, it stalled around the 100+ area before continuing on into a parabolic run. It would be surprising if we don’t see a decent bounce around the 100 sat mark.

- IEO coins usually move together with a tight correlation. There is the opportunity here to catch a ride if another IEO starts to move. Look at FET, ERD, ONE, etc.

- There is a tight stop opportunity here but BTC could stop you out quickly if people start to panic.

Bearish Scenario

- Bears ultimately want to see MATIC under 100 sats. Similar to a lot of great looking Altcoins right now, it’s far more profitable to be looking for cheap MATIC around these areas rather than expecting a full retrace. Considering MATIC started running from 50 sats and peaked at over 500, accumulating around the 100 area is a pretty good idea.

- Short term bears are more looking for a “buy or not” signal. It’s an attractive buy here but if you’re concerned about BTC moving and causing MATIC to break down, it’s better to wait for a break of the trendline with a good amount of volume.

6 | Enjin (ENJ / BTC)

So you like trend-lines, huh?

Bullish Scenario

- The Bulls want to see a retest of the trend followed by a bounce up to around the 1000 area which will provide some psychological resistance. Break that level and it’s a pretty quick move up to the 1050-1100 area.

- There is a pretty clear 10-20%+ play here if BTC lets Altcoins breathe a bit longer. Providing a tight stop opportunity of around 3-5%, the risk reward here is very attractive.

Overview

- After several rejections of this obvious trendline, we’ve finally got a break and a 4hr close above. There is a tight stop opportunity here. Buying in at around the 890 area, you’re looking at accepting a 4%+ risk. If you’re wanting to absolutely minimize your risk, wait for a retest of the trend around the 880 area with stops under 850.

- Having fully retraced from the famous “Samsung pump”, anything under 1000 sats is an excellent range to accumulate in. We know just how hard ENJ can pump and attract volume.

Bearish Scenario

- In a bearish scenario, the price breaks down under 850-860 and drops back down towards 800. We’d expect a double bottom type play to form at that level.

- Bears want to see this trend break end up being a fakeout. We’ve got a 4hr close above but seeing as BTC is due for a move, that might not be enough.

- We’ve said it a lot this week but at these levels, it’s far more profitable to look for buy opportunities rather than hold out for a lower buy that might now come. Unless BTC breaks up and makes another run for $14k, the bottom is more or less in for majority of Alts.