All metrics & charts included in this article are fixed at the time of posting. These will not be updated

1 | Bitcoin (BTC / USDT)

Not bear, not bull. Watching for now.

Bullish Scenario

- The bulls want to see a breach above the $11.1k area and a decent close on a higher timeframe such as a 4hr, 12hr or even better, a 1D close.

- If price breaches above $11.1k and holds we can expect either consolidation at that level or a bounce up towards $11.6k to $11.9k.

Overview

- BTC isn’t providing traders with a ton of confidence this week. We’re seeing a lot of traders try to trade the current price action and get chopped up by low time-frame wicks left and right.

- We’ll be sitting this week out until either the bears or the bulls settle this. Let everyone else lead the way before we join in.

- If we move above $11k convincingly and hold there for some time, that’s a great sign for the bulls. Lose support around $9.7k and $10k and we’ll start looking for longs around the $9.1k area.

Bearish Scenario

- The bears want price to break through that $9.7k to $10k area with a dump through to the $9.1k area.

- It’s possible that the $9.1k area fails to hold but seeing as we’ve only tested it once since we peaked out at $14k, it’s likely to at least provide a decent bounce play.

- Shorts in this area are generally seen as better risk/reward seeing as BTC is up an enormous amount this quarter. Profit taking is a natural part of any market and you can bet a few quick drops will cause a chain reaction.

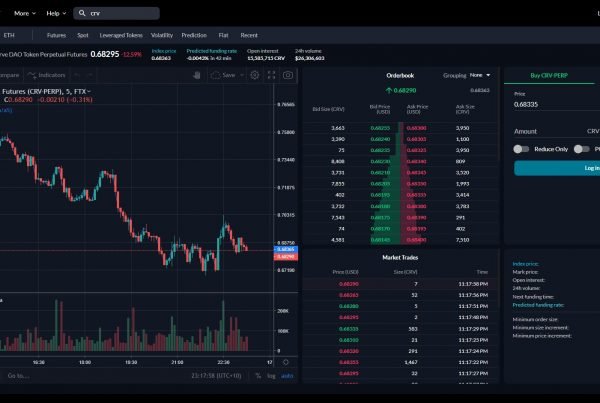

2 | Ethereum (ETH / USDT)

Bulls in danger. Leaning bearish.

Bullish Scenario

- The bulls really need a break above $240 followed by a bounce off of the recent rejections and previous support back in June. This movement will depend heavily on what BTC decides to do over the next few days.

- Bulls looking to long at around the $240 area would be looking at $260 to take profits. There is ton of chop around this area over the past month or two so it won’t be a smooth ride.

Overview

- Overall looking pretty bearish. There’s a lot of room for shorts here seeing as the next stop is a good 10% away at around $180-$190.

- After two quick rejections at the $235 mark over the past week, it’s evident that the bears are in control here until we see a break and bounce above $240.

Bearish Scenario

- Bears have a pretty obvious short opportunity here. After being rejected twice at the $235 mark, that level provides a decent stop-loss.

- If price breaks and bounces above $240, bears would be looking for shorts at around the $260 depending on the strength of the movement.

3 | Ripple (XRP / USDT)

The Bulls get their turn soon.

Bullish Scenario

- Despite the Alt market being far from exciting with most Alts slowly losing volume and slumping over, XRP is already in a position where you could be looking for reasonably heavy longs or even positional/swing trades seeing as we’re around 10% off of yearly lows. Ripple has always been a “shock and awe” type pumper but as we all should know by now, support tested multiple times often becomes weaker as a result.

- The upside XRP presents here makes a trade around this area provides a great risk/reward. Bulls want to see a bounce around the $0.32 to $0.30 area to take them up towards at least the $0.36 mark.

Overview

- XRP is looking very good around in this $0.30-$0.33 area. Plenty of previous history suggesting that we’re probably going to get another reaction in this area. If that were to fail we’d be looking at a drop as low as $0.28c where you could go in with a heavy long with a reasonably tight stop.

- Drop anywhere below that $0.28c mark followed by a close below + retest and we’re looking at $0.25c for our next stop. $0.28c is the lowest price XRP has dropped to in 2019 so far.

Bearish Scenario

- There isn’t a whole lot here for the Bears right now. Considering how close XRP is to yearly lows, the risk/reward isn’t awesome. If you had no choice but to short XRP you’re better of waiting for a confirmed break below $0.28c, until then, you’re probably better of shorting something else.

- If the Bulls do get their turn, consider a short at the $0.36 mark where a lot will be taking profits at resistance.

4 | Tron (TRX / USDT)

Ranging. Justin Sun & Warren Buffet have lunch.

Bullish Scenario

- The Bulls obviously want this potential inverse head & shoulders patter to break above and help reclaim the $0.03 area. With the upcoming Justin Sun and Warren Buffet lunch date and the publicity that comes with that type of event, it might be enough to help run the price through this high volume area.

- In a bullish scenario where we do reclaim that $0.030 mark, you’d be looking to take your profits at around the $0.034, Again, the risk/reward isn’t there just yet and you’ll likely take on less risk if you wait this one out.

Overview

- TRX is a bit of a hard sell right now. After losing the $0.03 area, retesting and then dropping down to a low of $0.02, the only thing we can see is a range being built between the $0.027 and $0.030 area or if you’re looking for patterns, a potential inverse head & shoulders.

- Another case where the best move is likely none at all. The $0.03 mark is not only a psychological level but was also heavily relied upon as support up until it broke down on the 11th of July. It’ll be hard to reclaim that on the first few tries.

Bearish Scenario

- The Bears want to see this range range break down and revisit the $0.026 area. Once again, there’s not a lot here in terms potential profit. If you’re a range trader that is comfortable with longing/shorting at critical levels, this could work out quite well. If you’re looking for a longer term position it’s best to let everyone else lead the way first.

- We mentioned in our “Bullish Scenario” section that the upcoming Justin Sun and Warren Buffet lunch date could spur some positive price action for TRX, but in a bearish scenario it ends up being a “sell the news” event. In any case, it’s likely that this range doesn’t last too long.

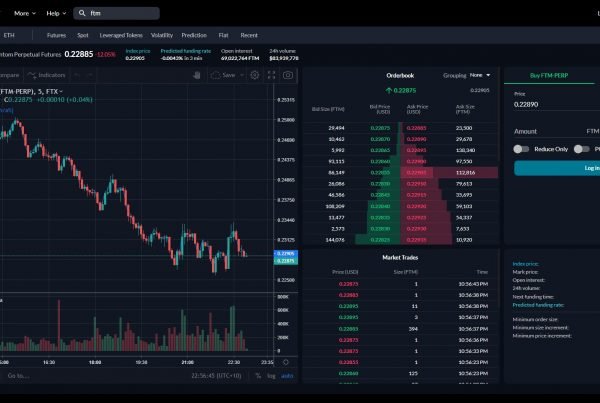

5 | Republic Protocol (REN / BTC)

"A Traders Dream"

Bullish Scenario

- The potential gain here isn’t great compared to the potential drawdown, especially if you’re considering buying REN above the 1000 area. Price discovery will continue once we break past 1600 and that could offer bulls a better opportunity at least in the short term seeing as there are no visible levels of resistance on the BTC pair from that point onwards.

- Bulls want to see a flip of the 1000 area with some convincing pumps around that range. Those that are looking for a more low-risk setup could consider buying in at the 800 area or if BTC starts shaking up Alts again, a buy at the pennant retest at the high 700s.

Overview

- REN has been a swing traders dream over the past few weeks. With several massive swings of around 50% – 80% happening every few days, it’s hard to ignore the price action on this one. Usually we’d wait for a third touch on a potential bullish pennant but REN has went ahead and consolidated below the third touch and broke straight above it.

- There’s far too much risk for the Bulls here but if we see some consolidation or a support/resistance flip at around the 1000 market, we could see another leg up towards 1160 and potentially continued price discovery on the BTC pair.

Bearish Scenario

- Bears want to see REN come back down to retest this high time-frame pennant where they’ll be looking to pick some up for a potential bounce. Seeing as REN likes to make big swinging movements and often boasts massive wicks, this potential bounce could yield fairly decent gains.

- Not really a bearish scenario, but a correction could be expected after such a huge run. Those who are patient will likely reap the rewards here.