ERC20 Token

Lition is developing the advanced scalable public-private blockchain with deletable data features, made for commercial products. This state-of-the-art protocol enables blockchain-based applications to step out of their current niche into commercial mainstream deployment.

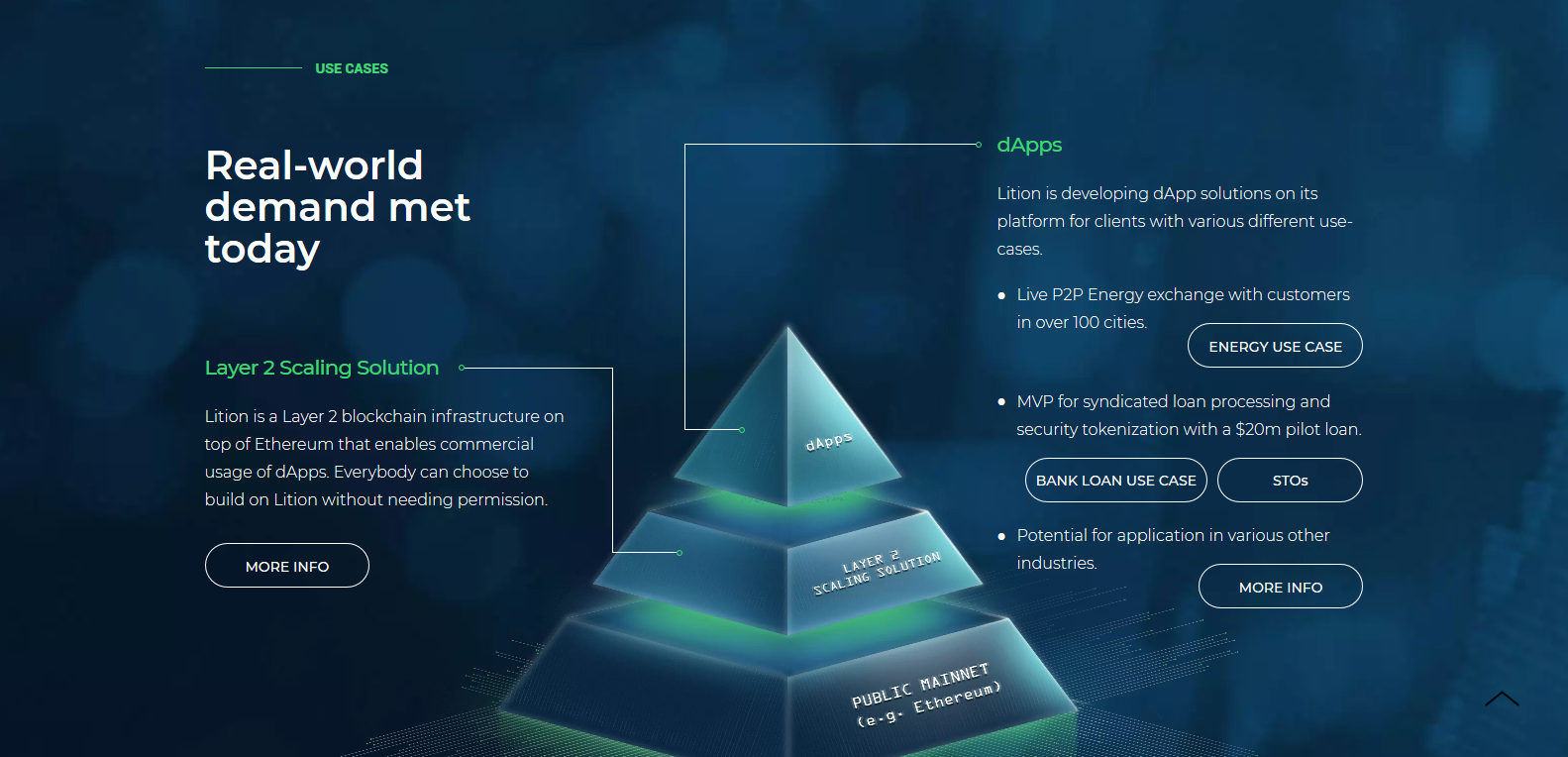

Lition is a Layer 2 blockchain infrastructure on top of Ethereum that enables commercial usage of dApps. Everybody can choose to build on Lition without needing permission.

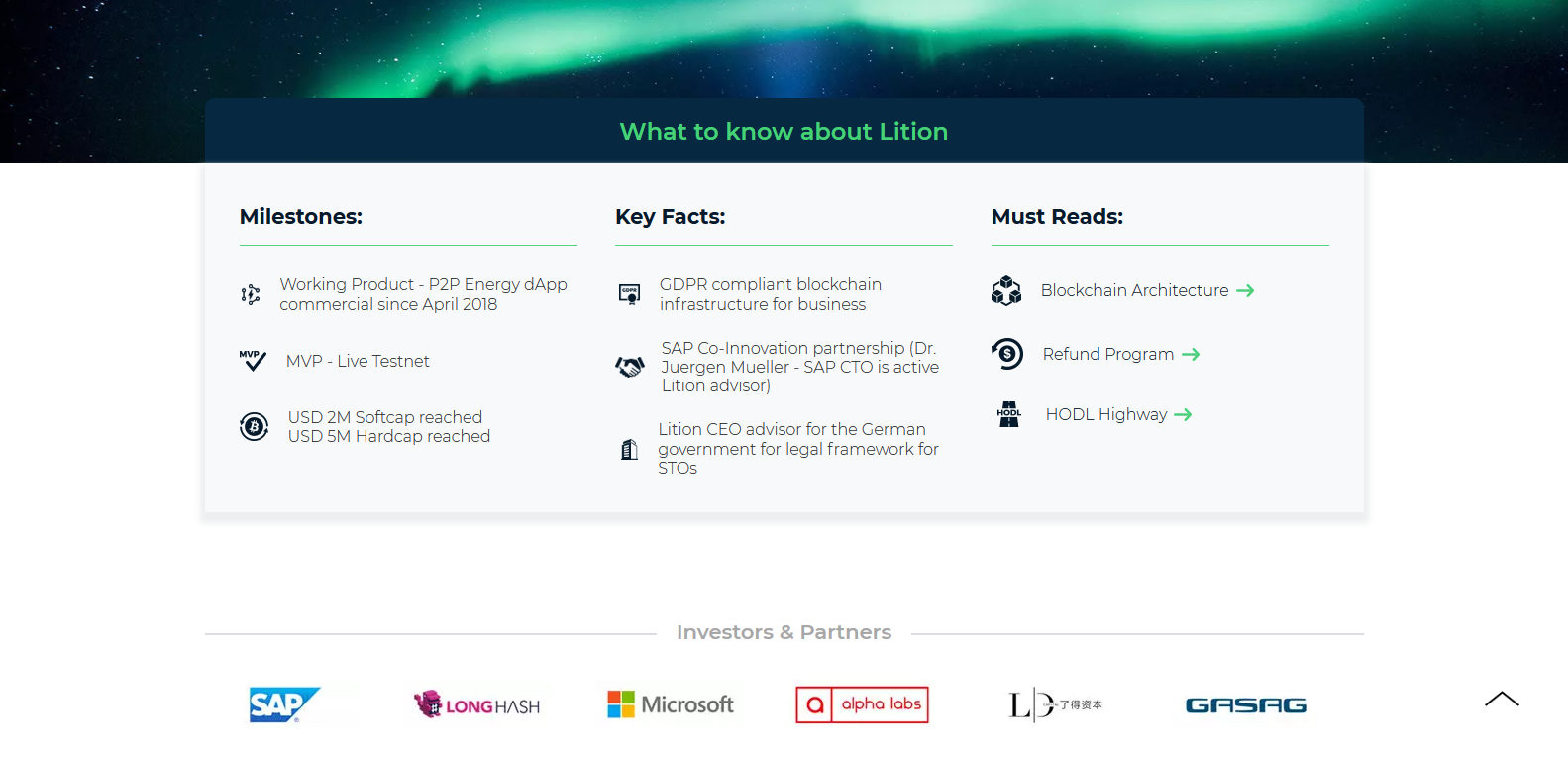

Some Features:

- Infinitely Scaleable – Every new sidechain increases throughput. Smart contract executions for $0.01 with 3-sec block confirmation times.

- Regulation-proof, deletable data – Store your private data only as long as you want to. Fully compliant with data privacy regulations.

- Built for Security Token Offerings – Made for European regulated STOs. Designed in cooperation with the German government.

- Data Privacy – Sensitive data is stored on private sidechains. Quantum-computer safe.

“Given the lack of existing solutions to satisfy the requirements experienced in a real, commercially productive blockchain application,Lition has designed a proprietary blockchain solution.”

Positives

- Lition is another exciting competitor in the BaaS space (Blockchain as a Service) that is currently gasping for creativity and innovation. Lition do a lot more than simply onboard businesses and integrate existing solutions with blockchain technology when compared to their competitors. Compared to a majority of the competition out there, Lition is branching out extensively in an attempt to cover a lot of ground over various sectors. Lition boasts full GDPR compliance with the ability to host STOs, enable energy trading, provide loans and even handle sensitive data in the healthcare industry. If that sounds like a ton of use-cases that aren’t related to each other in the slightest, that’s on purpose. We want to stress how flexible Lition can be for various business applications and needs. Healthcare, Pharmaceuticals, Automotive, Media and even more potential use-cases can be found here. While there are plenty of competitors in this space, there’s no doubt that Lition recognized this and expand the possibilities rather than focus on a “one size fits all” solution

- GDPR compliance is quickly becoming a hot topic among BaaS services. Projects that aren’t compliant have their Investors asking questions and projects like Lition are waiting to take those Investors on board with their Private/Public Blockchain Architecture which enables businesses to work with Lition knowing full well that their data is protected at all times. With full control over their data, sensitive information is completely protected with the same security you’d expect from a centralized, traditional solution. This not only enables businesses to rest easy but allows Lition to branch out into areas where data is extremely sensitive by nature. Hospital Records, Warehousing Data, Travel Details, the list goes on. This flexibility opens up a wealth of opportunities to explore with developers and big partners such as SAP and also offers them the opportunity to compete for more adoption in more industries.

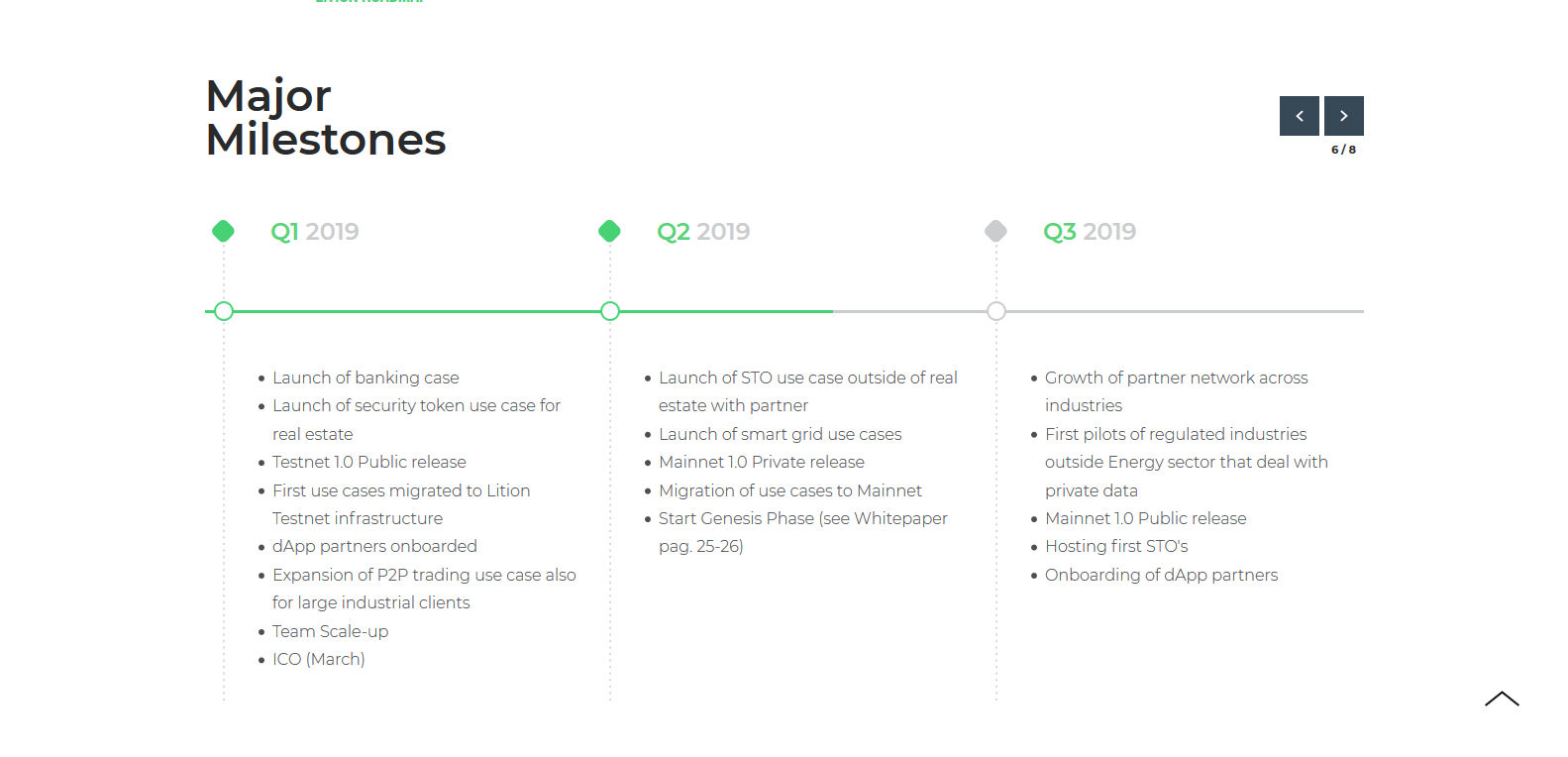

- One of the coolest things about Lition is the fact that they’ve already got MVPs (Minimum Viable Product) available. Starting off with their P2P Trading Platform, users will be able to trade energy in a P2P manner, allowing users to control their own energy bill directly, instead of being charged an arbitrary amount each period. (Check out a Live Demo). On the STO side, Lition has partnered with the likes of Tokeny to provide institutional grade solutions in the issuance, lifecycle management and secondary trading of digital securities. STOs are considered to be far more legitimate than ICOs as they are fully regulated and compliant with regulatory standards while still functioning similarly to tradition securities. Learn more about STOs on Lition. Lition also has plans to branch into Loans which is currently being tested by a partnership with two German banks. Learn more about Loans on Lition. As you can see the Lition Team is working hard on developing these MVPs in order to show off what they’ve accomplished in such a short period of time. Great stuff.

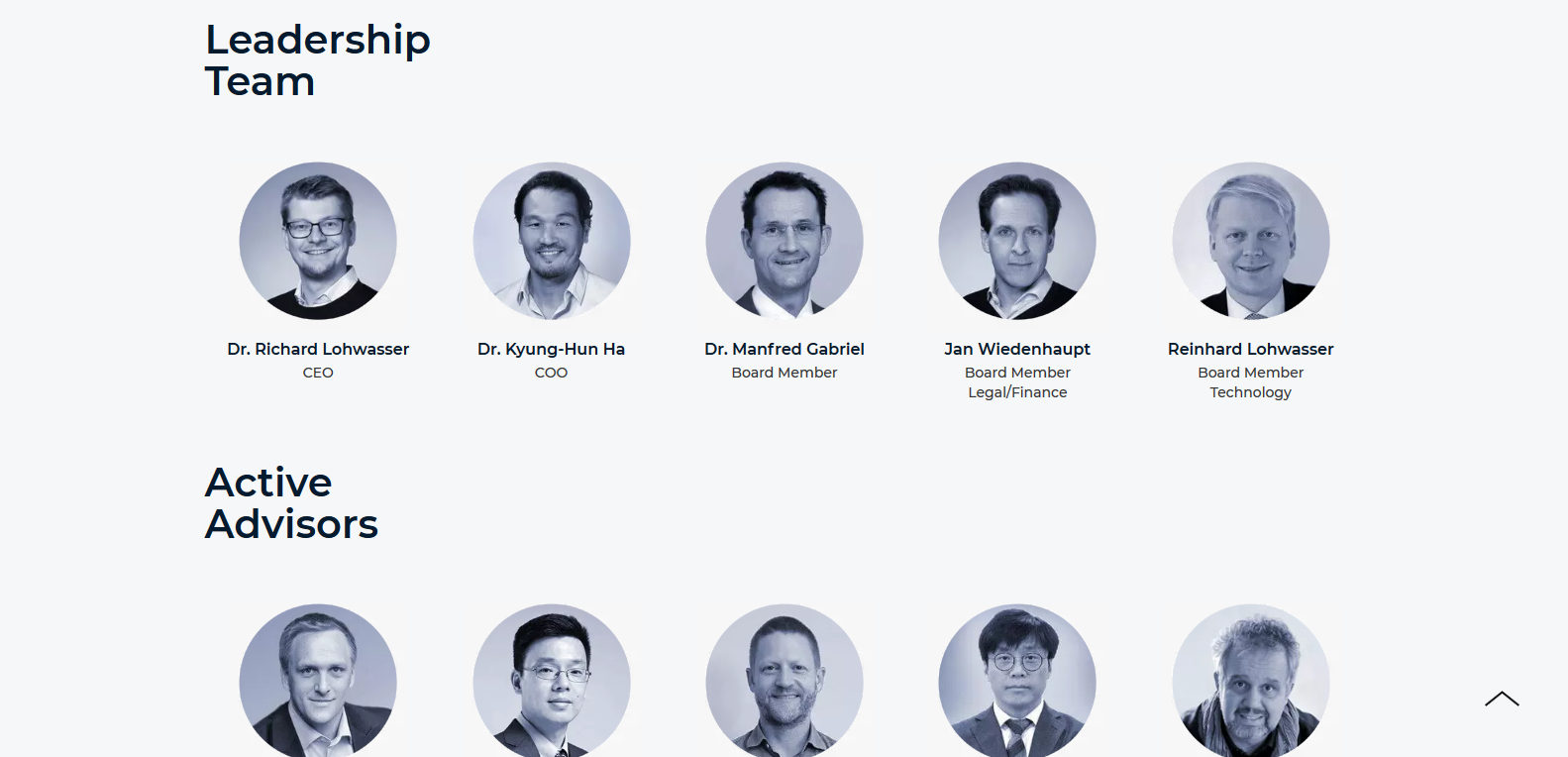

- Although we do often voice our concerns about a project doing “too” much, Lition is being led by an excellent Team that are incredibly experienced with building and deploying large scale business applications and products. Dr. Richard Lohwasser holds a Ph.D. in energy economics and is an international awarded IT specialist and blockchain expert. At 15, he was fluent in 7 different programming languages. Directly before Lition, Richard was managing director of German operations at leading independent international energy supplier ExtraEnergie, where he was responsible for >350 employees and US$ >1bn in sales. Dr. Kyung-Hun Ha has been a Director for Online at Vattenfall, one of four leading multinational energy conglomerates in Germany with more than US$ 10 bn in sales. Currently, he is a senior director responsible for operations at GASAG, a US$ 1,4 bn leading energy supplier in Germany. Not only is the Leadership Team extremely experienced to suit their roles, they’re also being advised by big names such as Dr Jurgen Muller (CTO and Board Member of SAP), Yan Feng Chen (Longhash Co-Founder) and many more talented minds. It’s safe to say that this is one of the best suited teams we’ve seen in a while. A huge plus from us.

- Some side notes here. Lition has a very good relationship with their Investors, despite our concerns around investor education. Their “Refund Parachute” protected part of ICO Investors funds in case of a massive fall in token value due to the current bear market (May 2019), guaranteeing them a set value buy-back if things were to go south. This shows an incredible amount of confidence as the Team is literally prepared to buy-back tokens if they cannot outperform market conditions, something that is very hard to do right now. Holders of the LIT token will also be able to stake their tokens in reward for a share of the traction fees, standard consensus stuff. What’s important here and the reason you’re reading this article is the decision to make on whether or not to “invest” in LIT tokens. The thing is, these projects are extremely B2B and Developer focused in the beginning especially. Investors are always after a tangible product or app that they can see and unfortunately with BaaS projects, a lot of this can go on behind the scenes. It’s very important to do your research and keep yourself up to date with what Lition is doing, because they’re definitely working behind the scenes at an impressive rate. From our point of view, Lition is a “set and (sort of) forget” investment, especially seeing as you can earn passive rewards for doing so. It’s very important to keep up with the competitiveness of the BaaS sector but Lition has a ton of potential here for the long-term investor.

Concerns

- When it really comes down to it, Lition is dipping it’s toes in the sea of Blockchain-as-a-Service (BaaS) solutions that are essentially fighting to present the most appealing product. What will separate Lition from similar projects such as LTO Network, Unibright and various other BaaS projects is their ability to communicate and network their solution to the right clients, something they’re currently proving to be exceptional at. It comes down to who can cross the finish line first in the race to secure big partnerships with similarly big names. Smart businesses/companies will be looking to adopt blockchain technology sooner rather than later in one way or another and BaaS projects such as Lition are ready to present themselves and their services. It’s a mixture of waiting for the blockchain space to mature and keeping up to date with who’s leading the charge in this particular niche. Lition have some very unique products up their sleeve as stated in our “positives” section but the competition will be absolutely fierce as this sort of niche isn’t exactly a “rising tide lifts all boats” situation. If you’re looking to invest in Lition or any BaaS project for that matter, it’s extremely important to keep up with the progress of not only your project of choice but their competition as well. Things will move fast once these projects and their services are utilized by more mainstream businesses.

- The one thing we’ve noticed throughout our research is that Lition has a lot of eggs and they’ve put one in pretty much every basket. While it’s awesome to see such a versatile product/s, it honestly took us a bit longer than usual to really grasp what Lition is trying to do. An energy trading platform? A GDPR compliant BaaS product? An STO platform? Well, it’s all of those things actually, it’s just a bit overwhelming at the start. We can’t count the amount of times we’ve used the old “jack of all trades, master of none” phrase but it applies here too. That isn’t to say Litions Team can’t handle building a product capable of all of this (they can), it’s just something that isn’t explained very well from a first glance. If you’re a real Investor you’ll take the time to look past the front cover.

- Not a lot of other major points to be made here. There is some talk and concern among the community regarding the token lockup period for seed and private round Investors being quite short compared to other projects with a full token unlock by the end of 180 days. Usually we do see projects take on a multi-year lockup period. This is far less to do with the fundamentals of Lition and if you’re a long term investor it shouldn’t concern you too much. There is also a large amount of coins that are yet to enter the Circulating Supply (82% at the time of writing in May 2019). These two points could very well influence the price of the LIT token down the road, but changes nothing about the projects progress. Not much else from us here. Lition are have a very good chance of making some noise in this category of the blockchain space. The tech and fundamentals are all there as we’ve discussed, our concerns are more about how the project will fair in terms of progress against competitors in a fierce niche that isn’t slowing down. If they keep up at this pace they’ll do very well indeed.

View Screenshots

Token Details

Token Type

ERC20

Powered by the Ethereum Network. Can be stored on any ERC20 compatible wallet e.g MyEtherWallet

Token Statistics

Supply

• Ticker: LIT

• Circulating Supply: 24,111,769 LIT

• Total Supply: 145,026,766 LIT

• Token Use: Services & Fees

Founders

The Team

• Dr. Richard Lohwasser (CEO)

• Dr. Kyung-Hun Ha (COO)

• Dr. Manfred Gabriel (Board)

• More

Industry

& Competitors

• BaaS Platforms

• App Platforms & Frameworks

• Competitors – Unibright, LTO Network, etc.