ERC20 Token

Own is the platform to buy and sell shares — business owners can sell equity in their businesses to raise capital and investors can buy and sell shares from businesses. You can see the Own Market prototype on their website. Like all good ideas, at its core the platform is really simple.

Own allows business owners to sell equity in their business in return for capital from investors. Own can offer this service free of charge to both business owners and investors because they keep their processes simple and utilize blockchain technology.

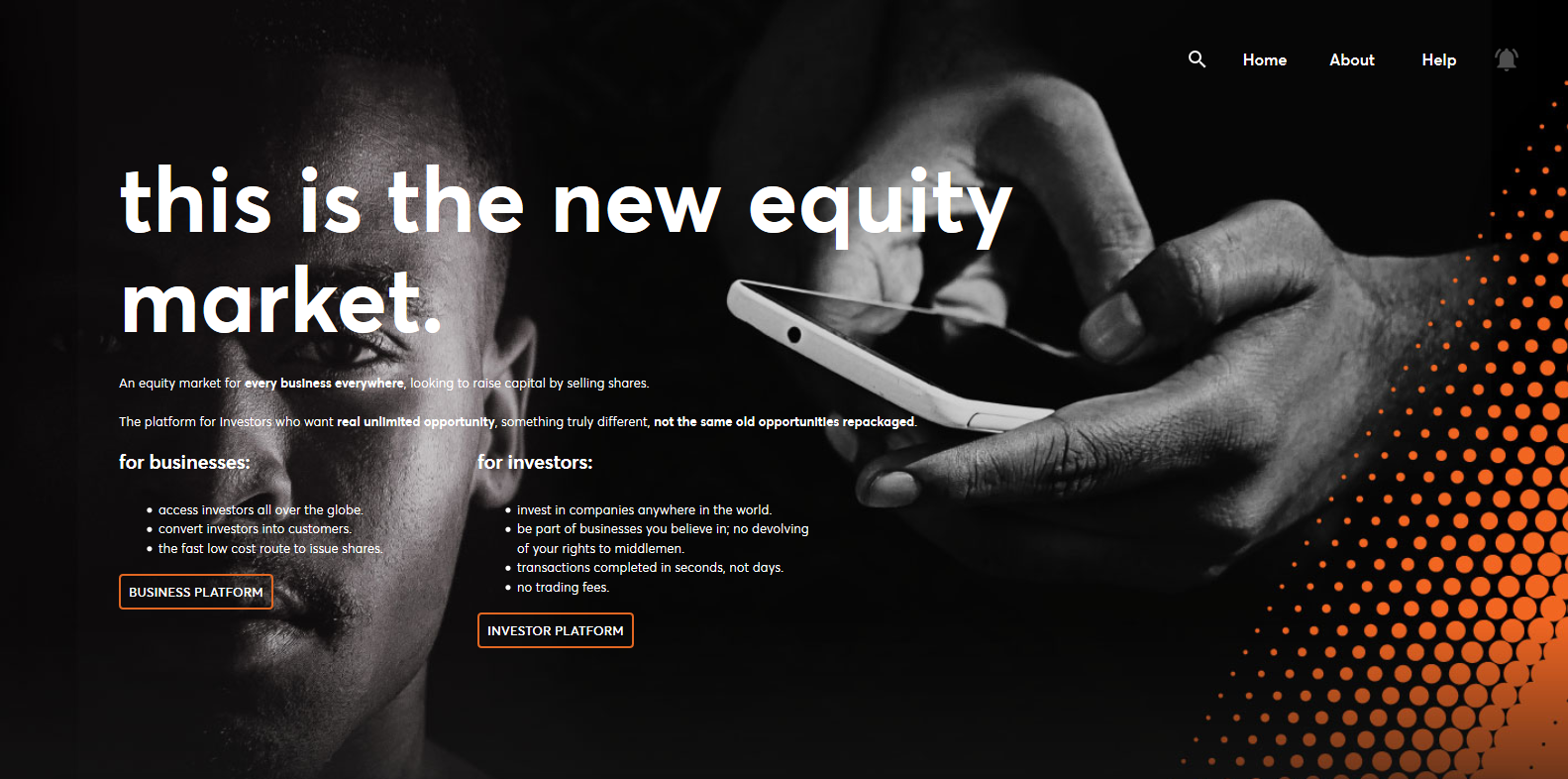

- A Dual Blockchain – Own Markets blockchain is purpose-built to handle publicly available data, as well as confidential data – a unique challenge for the equity market.

- Fully Scaleable – Own Markets blockchain is built to scale – for big businesses with millions of shareholders and global investors. Providing stability.

- The Standard – Own is building a global digital share certificate that they intend to become the new global standard. Their blockchain is specifically built for digital share transactions.

“We’ve created the alternative. a fair, supranational exchange. it’s fast, scalable, decentralised, transparent and secure. in short, it’s the equity market as it should be.”

Positives

- Investing in equity markets has traditionally been very hard for small investors and just as hard for business owners looking for further funding. You’ve either got the big bucks to invest, or you don’t. It’s safe to say many haven’t even considered getting into the Equity market simply because it’s daunting right from the start. Companies looking to share out their business in return for funding have either had to play by strict rules set out by middlemen looming above them or simply remain private, stunting a lot of potential growth. It’s not hard to point out why a Decentralized Equity Market solution like Own is a no-brainer. They’re taking an industry worth trillions of dollars and simply removing the unnecessary middlemen. No crazy fundamental differences, no hoops to jump through, no hassle, Just Businesses interacting with their investors. We love seeing freedom brought to industries that are heavily controlled and Own is a perfect example of this.

- Without going into the Own Whitepapers too much in an attempt to avoid spelling every small detail out in this review, there’s some obvious positives that come along with a Decentralized Equity Solution. Business owners can control every aspect of how they plan to offer shares in their business and investors can buy/sell/trade with the same confidence that they would in a traditional market seeing as everything is handled on the blockchain out in the open. With Own, everyone involved avoids the exorbitant fees of traditional markets and in the end, everyone wins. If these types of platforms take off they’ll do so in a big way. The Equity Market is estimated to handle around $100 Trillion in assets by 2020, if solutions such as Own can capture even 1% of this figure combined in the next few years it would be incredibly rewarding to those investing in these platforms today.

- Taking a look at the CHX token, we know what the majority would be thinking: “but CHX must be a security token, right”. A big fat wrong. CHX is just a means of function on the Own platform with use-cases spread throughout the workings of the platform. It’s a token model we’ve seen successful time and time again where the platform is designed in a way that makes the CHX token essential. Business owners who wish to acquire funding are required to lockup their CHX in a Smart Contract agreement as a sort of “trust” that they’re serious and in it for the long run. Investors can utilize various services on the Own platform including Investor Insights and various other services that even seasoned investors will benefit from. The CHX token is one that’s safe from regulatory crackdown and serves as a vital cog in platforms function which is exactly what we like to see.

- When it comes to the Team behind Own, it’s important to consider what strengths would be required to pull off this vision. Years of Blockchain/Crypto experience? A big plus but probably not critical. Years of experience in the Global Equity/Share Market? Absolutely critical. We’re happy to see that the Team is extremely well suited to their roles. Sascha Ragtschaa (CEO & Co-Founder) has spent the past 17 years working for the largest global share registry and transfer agency provider in the world, and held various technology leadership roles in Europe, Australia and North America. In his most recent function he was the Chief Information Officer for Europe, Middle East, Africa and Asia, managing 421 staff across multiple locations and countries, covering the end-to-end technology delivery and servicing lifecycle of a global organization. | Florian Batliner-Staber (COO & Co-Founder) spent 2006 through 2017 as the Head of Technology in Continental Europe for the global market leader in transfer agency and share registration, employee equity plans, proxy solicitation and stakeholder communications. Florian managed both IT infrastructure and software development projects, as well as product management. He has been responsible for the rollout of global back of office software products as well as the implementation of large-scale applications in the financial services industry in Europe. | We could go through the whole Team individually and you’d see a similar story. All very experienced in their roles.

- We’ll talk more about the price of CHX in our “Price Prediction” section below but for now we’re going to point out WHY the CHX token should appreciate nicely. With the various token use-cases for both Investors and Business Owners in place and a relatively low Total Supply of 168,956,522 CHX, there’s plenty of potential for CHX to become pretty scarce pretty quickly. We’ve seen countless projects incorporate a use-case for their token which requires some sort of long-term hold and this inherently causes scarcity by design, Own has nailed it in this regard. Investors aren’t burdened by having to own CHX to perform every trade they wish as the platform will offer a fiat gateway and accept other Cryptocurrencies at the same time. Own makes it easy for Users to invest while keeping Businesses up to scratch through the CHX lockup feature. It’s a win-win model that doesn’t prevent organic growth at any point.

Concerns

- We’re just going to point of the obvious in this first “concern”. Security Token Offerings (or STOs) and Securities on the Blockchain are extremely new to the Cryptocurrency space. Securities in traditional markets are extremely locked down and under the close watch of regulatory boards such as the SEC in the USA to ensure everyone is playing by the book. Securities on the Blockchain will no doubt cause a stir and attract a lot of attention due to the lack of control these regulatory boards will have over them from the start. Consider how worried investors have been about various ICOs potentially being considered “securities” over the past year. Now take a guess at how “Security” Token Offerings will sit with these regulatory boards. It’s a developing space and one that is bound to see controversy as it becomes more popular. With all of this considered it’s worth pointing out that the SEC isn’t the be all and end all of the equation, they’re only concerned with what goes on in the USA. Were sure Own has their Legal Team all over this and is aware of different countries various regulations.

- The STO scene is quickly becoming more and more popular as the Cryptocurrency space matures and further potential is realized. There are some pretty serious players in the Security Token space and we’re betting there will be more on the way. Adoption is largely dependent on what platform offers the most accessibility and ease-of-use. Securities are a whole different ball game to regular everyday investors and education is where the leaders will gain their edge. If Own can make STOs as attractive to the regular investor as ICOs were in 2017, expect some explosive growth. With that being said, it’s fair game to any competitors out there right now. Everyone is on a level playing field right now until we see some serious interest.

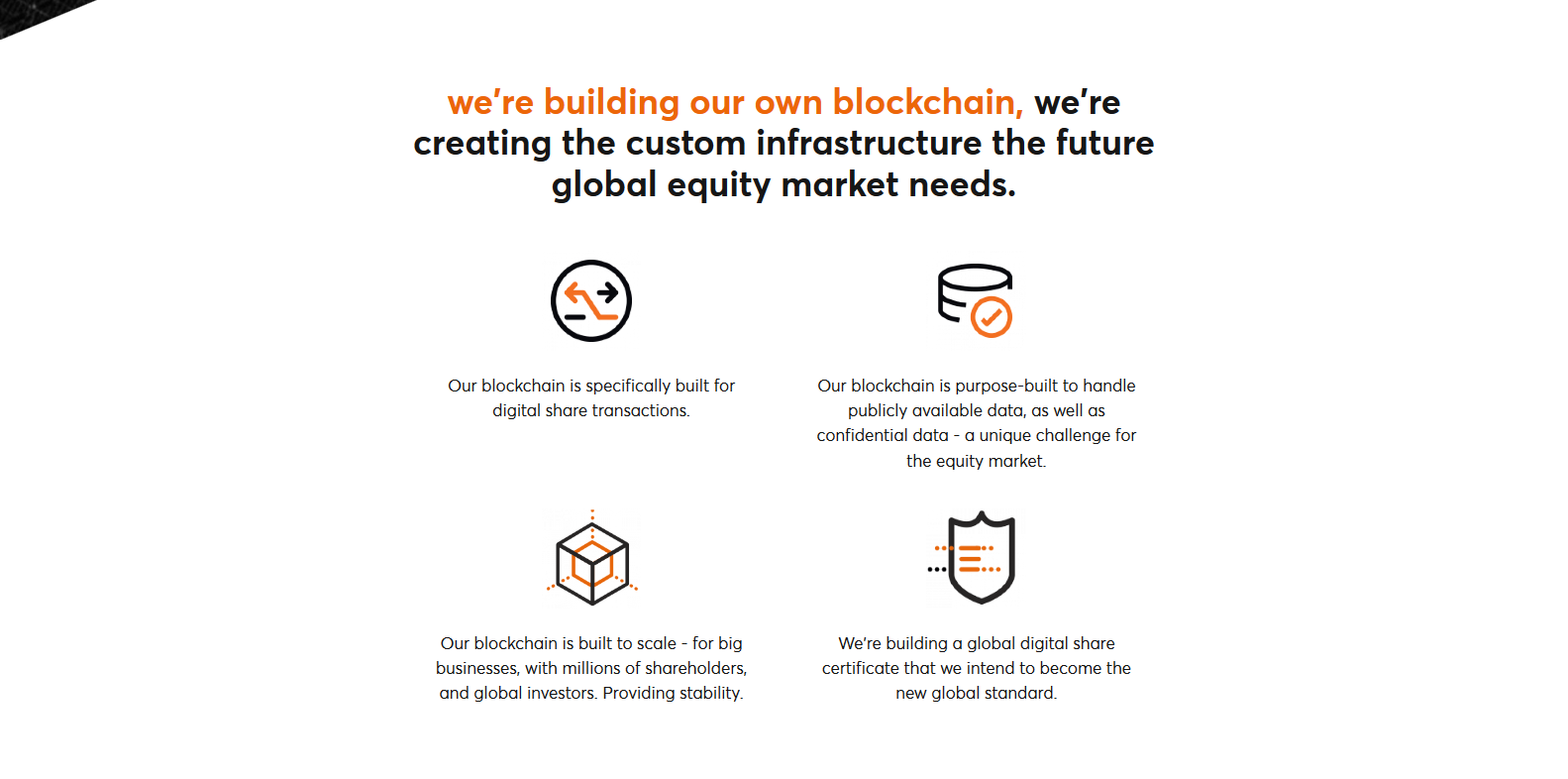

- No other real concerns here. As you can tell our main concerns are simply around regulations and adoption. In such a new space that’s really all we can point out until competitors start to separate themselves with various points of difference. While we’re here it’s worth pointing out that Own is already in the late phase of their initial Roadmap, rolling out their 2.0 Platform release supported by some planned marketing. They’re definitely making some headway already.

Price Predictions

- Please note: This Price Prediction section was a feature voted on by our community on Twitter. We do not stand by any of the following statements, we are merely speculating. We have been known to be pretty bullish on most projects we review, so take our predictions and DYOR.

- As always, we like to take a step back and look at projects from a purely investment based perspective. CHX will no doubt see a ton of organic price growth through exchange listings and planned marketing in the future. Any investments now would have a pretty good chance of appreciating from these catalysts although it should be noted that at the time of writing CHX has seen a very strong run up in price, so pick your entry carefully as things inevitably cool down (November 30th 2018). Now sitting at around a $8m Market Cap after an impressive run from a $1m Market Cap back in October, CHX still has a huge amount of growth potential in the long term based on fundamentals but like we said previously, pick your entries. FOMO is a b***h and everything retraces eventually when people take profits. Once we see significant demand for Security Tokens you can bet Own have a piece of that market. With the idea of STOs being so new it’s important to understand you may need be invested for while before we see platforms like Own take off and discover their own value. It’s also important to note that with any new concept/space, there’s a fair amount of risk involved. Always DYOR and pay attention to development in this space.

- Short term (< 3 Months) We think CHX could be sitting anywhere from a stable $0.20 to $0.40 taking the current market conditions into consideration. (November 2018)

- Mid Term (6 – 12 Months) we think CHX could be a stable $0.50 to $2.00, especially if the market turns around in the next few months.

- Anywhere past 12 months would be impossible to accurately speculate on but we’d be confident on a $2.00 to $5.00+ CHX in 1+ years, especially if we see the STO space take off like some are expecting it to. But again, it may be a ways off.

- The current circulating CHX supply is just under 72,000,000 Million (November 2018), so a $5.00 CHX would see a return to that $360m+ valuation. Is this a high prediction? Absolutely. This all depends on how successful the STO space is over the next few years but if they do garner significant adoption in say 2-3 years, the number could be even higher.

- As with any investment, you absolutely must do your own research. We are by no means providing financial advice. Be smart!

View Screenshots

Token Details

Token Type

ERC20

Powered by the Ethereum Network. Can be stored on any ERC20 compatible wallet e.g MyEtherWallet

Token Statistics

Supply

• Ticker: CHX

• Circulating Supply: 72,264,765

• Total Supply: 168,956,522

• Token Use: Services & Fees

Founders

The Team

• Sascha Ragtschaa (CEO)

• Florian Batliner-Staber (COO)

• Ermin Dzinic (CTO)

• More

Industry

& Competitors

• Equity Markets

• Finance Services

• Competitors – Polymath, Dusk.