Network Token

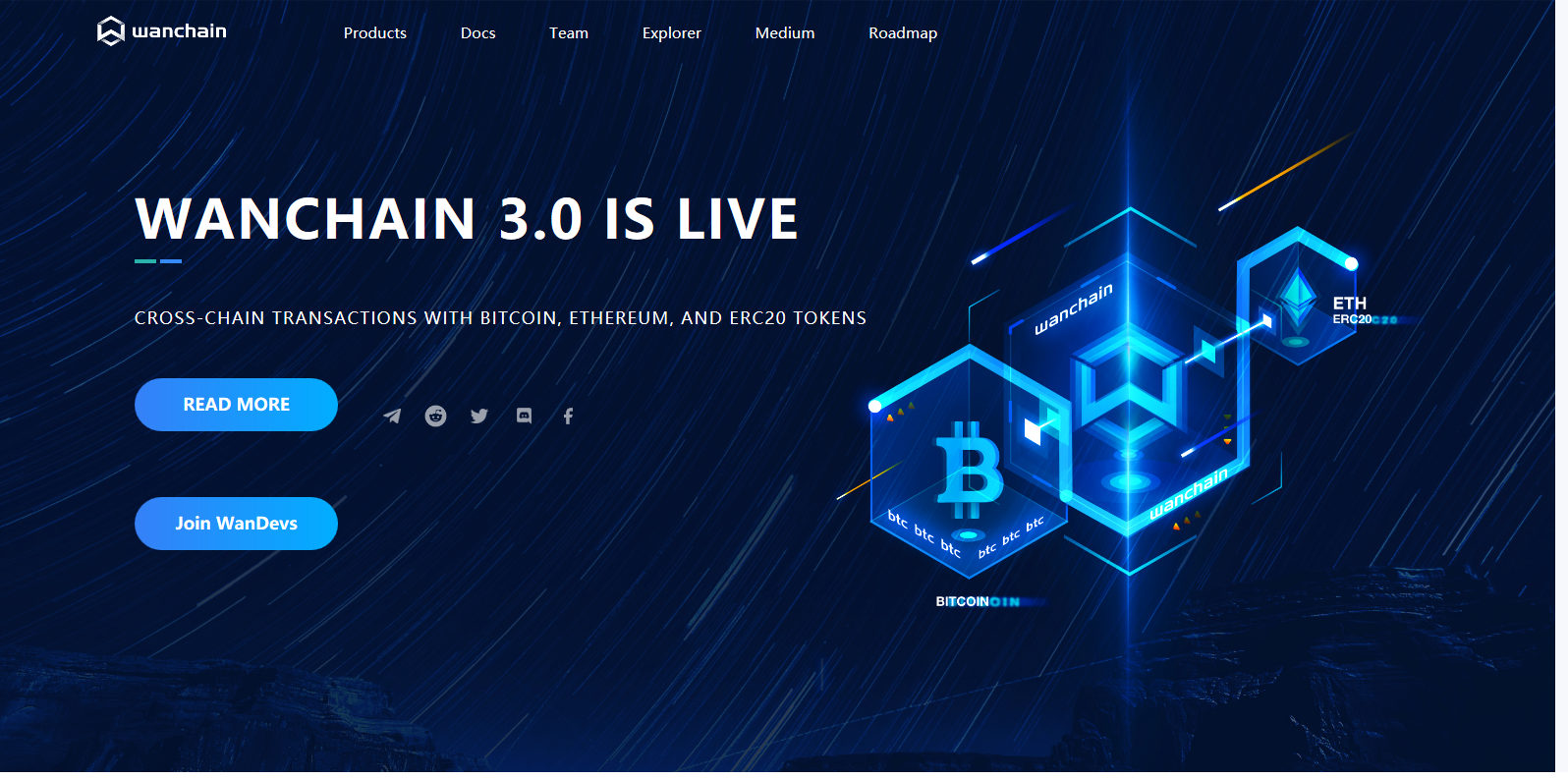

Wanchain aims to build a super financial market of digital assets. It is an infrastructure connecting different digital assets. With this infrastructure, financial services based on different digital assets can be carried out in a distributed way, finally forming a financial market composed of different business providers, application developers and clients.

Some Features:

- Privacy – Ring signature provides complete anonymity to the signer of a transaction, and yet provides the ability for the receiver to correctly verify that the sender did in fact sign the transaction. The optional One Time Addresses (OTA) provides complete anonymity for the receiver of every transaction. Private Send function breaks down every transaction input to a standard denomination, thereby providing further obfuscation to the transaction amount

- Cross-Chain – Based on complex algebra, locked accounts with SMPC enables low threshold to convert any digital asset from any blockchain into a corresponding proxy asset on Wanchain’s blockchain. This unleashes the power to build compelling distributed cross-chain Dapps and removes centralized counterparty risk. Wanchain will support ERC20 and protocol tokens

- Smart Contracts – Wanchain’s blockchain builds upon the strengths and robustness of Ethereum. Any Ethereum Dapp will run on Wanchain with zero code changes, yet, applications can be enhanced with Wanchain’s APIs to leverage privacy protection and cross-chain capabilities

“Bitcoin was the first natively digital asset, tens of thousands have followed. The digital economy is expanding exponentially and will soon become ‘the economy’. The problem is that today’s digital assets are isolated on their respective chains. Wanchain connects these assets and enables banking applications to be developed that guide their flows on-chain, removing centralized counterparty risk.”

Positives

- Wanchain is one of the most exciting projects to come out of the ICO-mania that was the 2017 bull run. With a product vision that was extremely ambitious but with a strategy that made their idea feasible, Investors looking for a long term hold had BTC ready to dump into WAN as soon as it listed on exchanges. While a ton of projects had “listing fever” as people who missed out on various ICOs climbed over the top of one another to get that “listing pump”, Wanchain (WAN) was a project many were happy to hold for years to come. Fast forward to April 2019 and Wanchain has destroyed all doubt and exceeded every expectation Investors had for it. While the bear market has had a big impact on the price of powerhouse projects, Wanchain included, the fundamentals have only gotten stronger, especially with the long awaited release of PoS (Proof of Stake) requirements further incentivizing long term sustainability. Please note: we will NOT be exploring the in-depth technology behind Wanchain, we’re simply not going to try and explain how the Wanchain cogs turn when you can get it straight from the source (Wanchain Whitepaper).

- When we say Wanchain is a powerhouse project, we’re talking about the sheer scope of what they’re building and have built already. With a big focus on allowing financial institutions to transact on the blockchain with the same level of privacy that they’re use too, Wanchain is building the on-ramps for big money to flow into the blockchain/DLT industry. Where Wanchain really shines is its blockchain interoperability. The last thing big financial players want is to be told “You need x coin to do x”, they’ll shrug their shoulders and “go back to what works”. Wanchain knows that unless blockchain technology can provide benefits over legacy systems, institutions aren’t going to switch up what they’re doing just to utilize this new technology. With the ability to invest, pay for services, provide finance, settle contracts and just transfer wealth in a decentralized, private manner, institutions and companies looking to deploy financial applications on Wanchain are on solid ground. Dapps and Smart Contracts are a standard on Wanchain and anyone familiar with Ethereum knows how important those features are to the fundamental strength of a project. When it comes down to a choice between exploring the possibilities of Ethereum or Wanchain, there’s enough reason to skip Ethereum entirely with what Wanchain can provide on the Fintech side.

- The strategic partnerships Wanchain has made in such a short amount of time are seriously impressive. Alongside Icon and Aion, Wanchain is part of the “Blockchain Interoperability Alliance”, laser-focused on bridging the gap between blockchains which has been an obvious barrier to mainstream adoption that needs to be tackled soon. In a space where partnerships are often announced and never brought up again it’s very refreshing to see three Teams pumping out developments at an impressive pace. Other notable partnerships with blockchain companies include an integration with EOS (EOS) and another impressive partnership with Chainlink (LINK), and that’s just scraping the surface. Not only has Wanchain shown that they’re more than able to produce a technically and fundamentally sound project, they’re actually able to market it and network their efforts just as well, something very few projects can pull off.

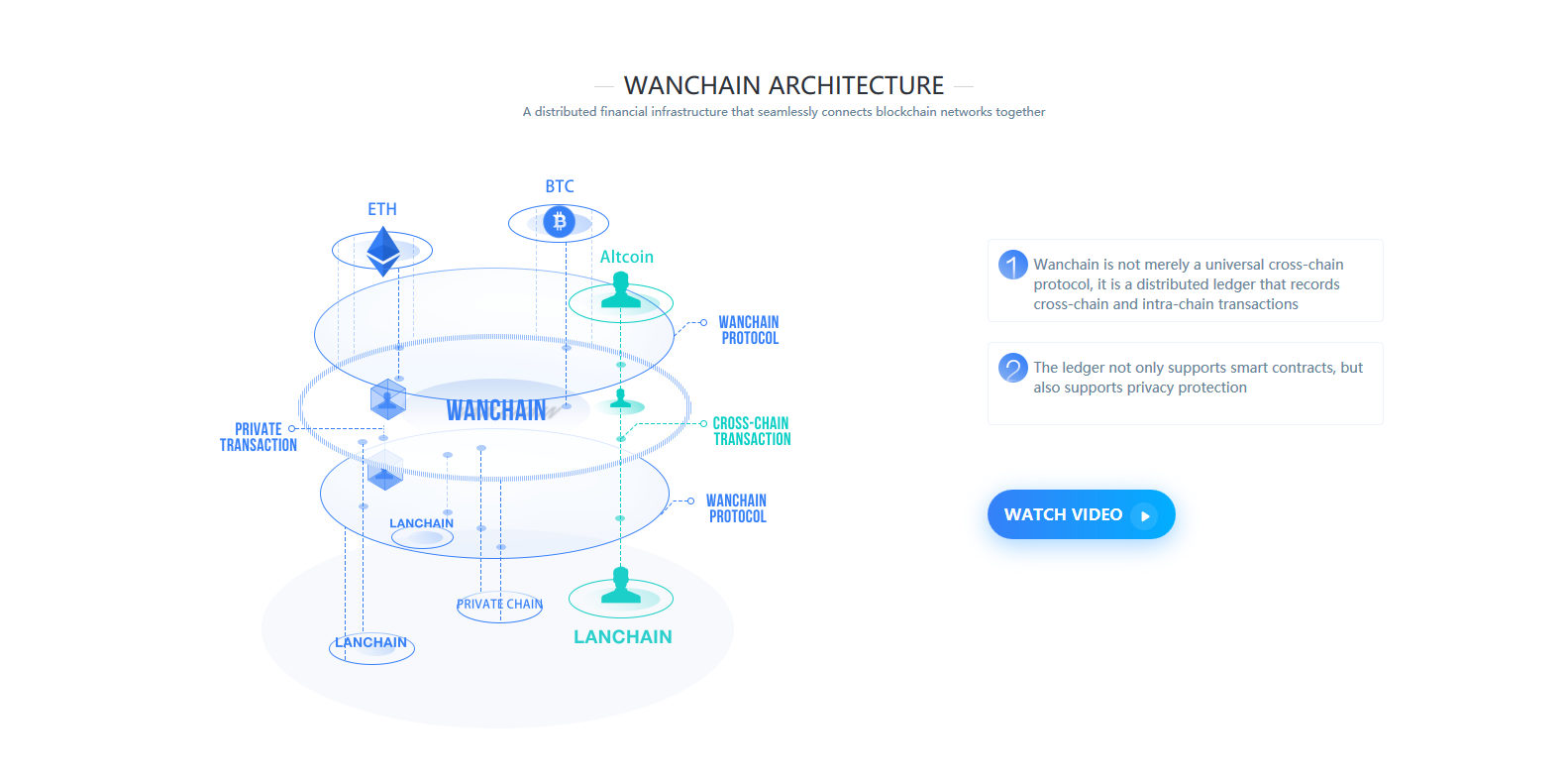

- We’ve seen countless projects plan out an extremely ambitious roadmap only to have completely overestimated either their own abilities or the resources available to them. Wanchain has one of the best Teams we’ve seen in the space (and we’ve seen some crazy talented and experienced Teams). Jack Lu (CEO & Founder) has previous experience as the CTO & Co-Founder of Factom, was a Software Architect for HP and Xerox and if we really wanted to, we could pull up some of the positions he had back in 1999, that’s the caliber of experience these guys have. It’s always great to see a CEO that actually has hands-on experience and what is evident to be a deep technical vision into how Wanchain will change Fintech in a big way. Ni Li (VP of Business Dev) and Weijia Zhang (VP of Engineering) have both worked for companies such as Dell and Vodafone in lead roles. The decades of combined experience the Team have in building and deploying products/technology on a large scale should speak volumes to Investors looking for a project that’s in safe hands.

- If you’re looking to build a long term portfolio that you can look back on in a few years time, WAN should be a percentage of your holdings. Fintech applications will be some of the first utilized by financial institutions looking to explore blockchain technology (obvious, we know) and they’ll want an introduction that leaves a great first impression. You shouldn’t underestimate the amount of money that could flow through the services Wanchain will provide and holding WAN is a sweet bet that you’ll have a valuable asset that is vital to the function of one of the strongest projects on the market today.

Concerns

- If you’re out looking for “red flags”, you won’t find any in Wanchain. While no project is perfect, Wanchain has proven itself to be an absolute monster from an innovation standpoint. While leading the pack isn’t always the best position to be in, they’ve been in that position for a while now. We do see a potential “jack of all trades, master of none” situation as we observe other projects focus specifically on some sectors that Wanchain is involved in. You’ve got projects that are solely focused on developing the best Decentralized Exchange, the best Dapp platform or best Smart Contracts, etc. It would be foolish to assume Wanchain will fend off all of their future competition but as they say, competition breeds innovation and if Wanchain has proven one thing in their time on the scene, it’s their ability to innovate and think ahead.

- One thing that Investors need to keep in mind, not only regarding Wanchain but any Fintech project is the time to market factor. While projects in various other sectors of the cryptocurrency space are sporting shorter roadmaps with more frequent milestones and in some cases partnering with well known brands that you may see pop up in your day to day life, Fintech projects such as Wanchain can often take a seat on the bench as focus shifts to projects that are making a ton of noise and attracting an audience. The best way we can describe it is the following: Investors want to “see” their project in the mainstream and with Fintech, a lot of this happens in the background, that’s just how it is. Wanchain is the sort of project that you “invest” in. The best returns will come to those who are prepared to be invested in a project for the long haul. If you’re looking for a quick flip or a swing trade based on news events, Wanchain probably isn’t your coin. The time to market here is definitely longer than most other projects but if you’re building a long term portfolio, WAN needs to be in there.

- As you can see based on our “positives” and the few “concerns” we have stated above, there’s definitely no “red flags” when you’re taking a look at the fundamentals behind Wanchain. If we had to point out one issue that we’ve noticed over the time WAN has been trading, it’s the lack of education that investors and speculators seem to have when they’re doing their own research. Wanchain is a fundamental powerhouse but like many other projects in the Fintech space, it’s extremely easy for these strong fundamentals to be missed by people who don’t look past the front cover. We don’t see any issue with Wanchains marketing efforts, it’s very similar to the way other projects such as Icon are misunderstood. It takes a lot of research to really appreciate what the Team behind Wanchain is doing, but if you take the time to do your own research, it’s a sound investment into the blockchain interoperability space.

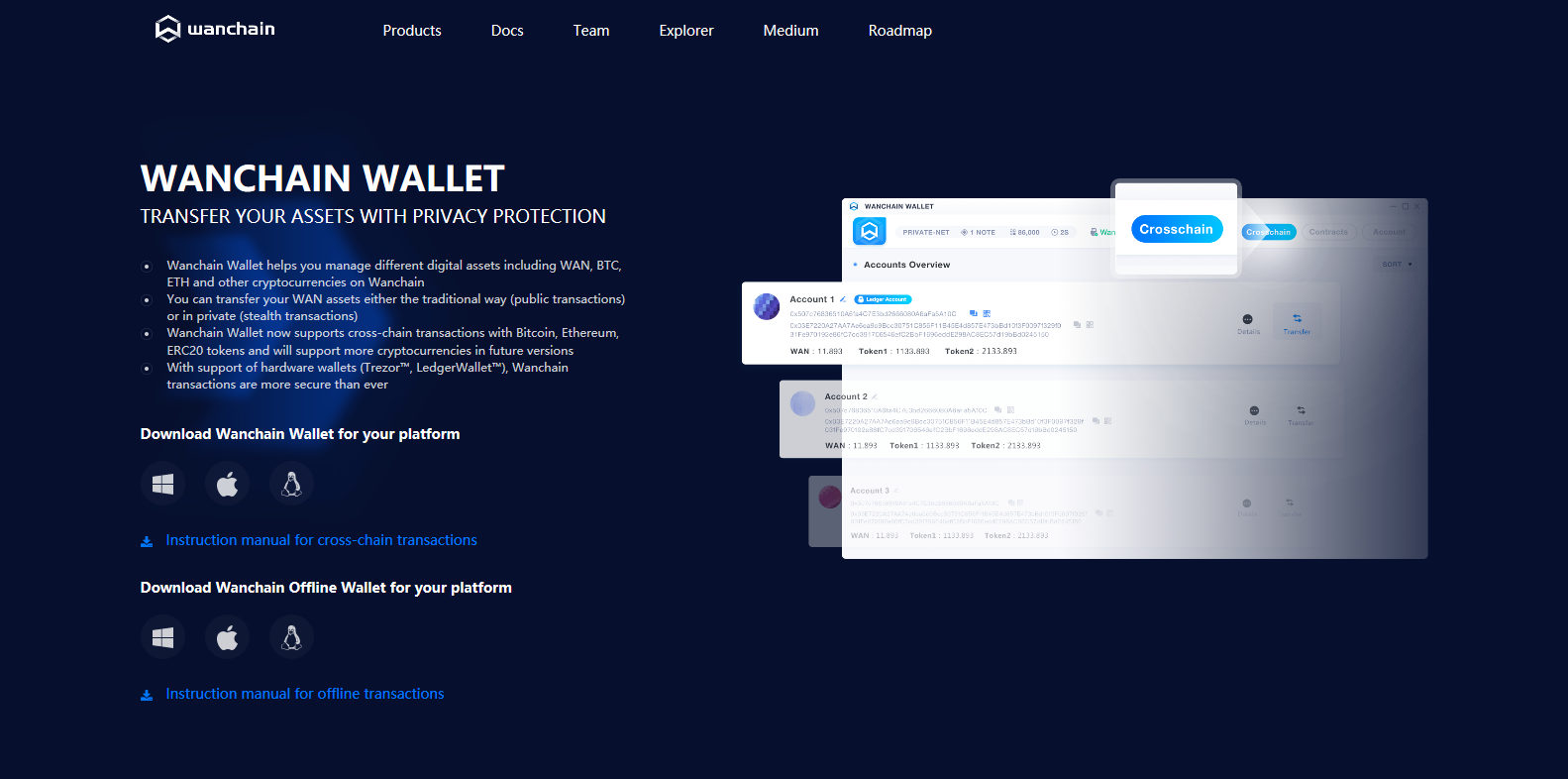

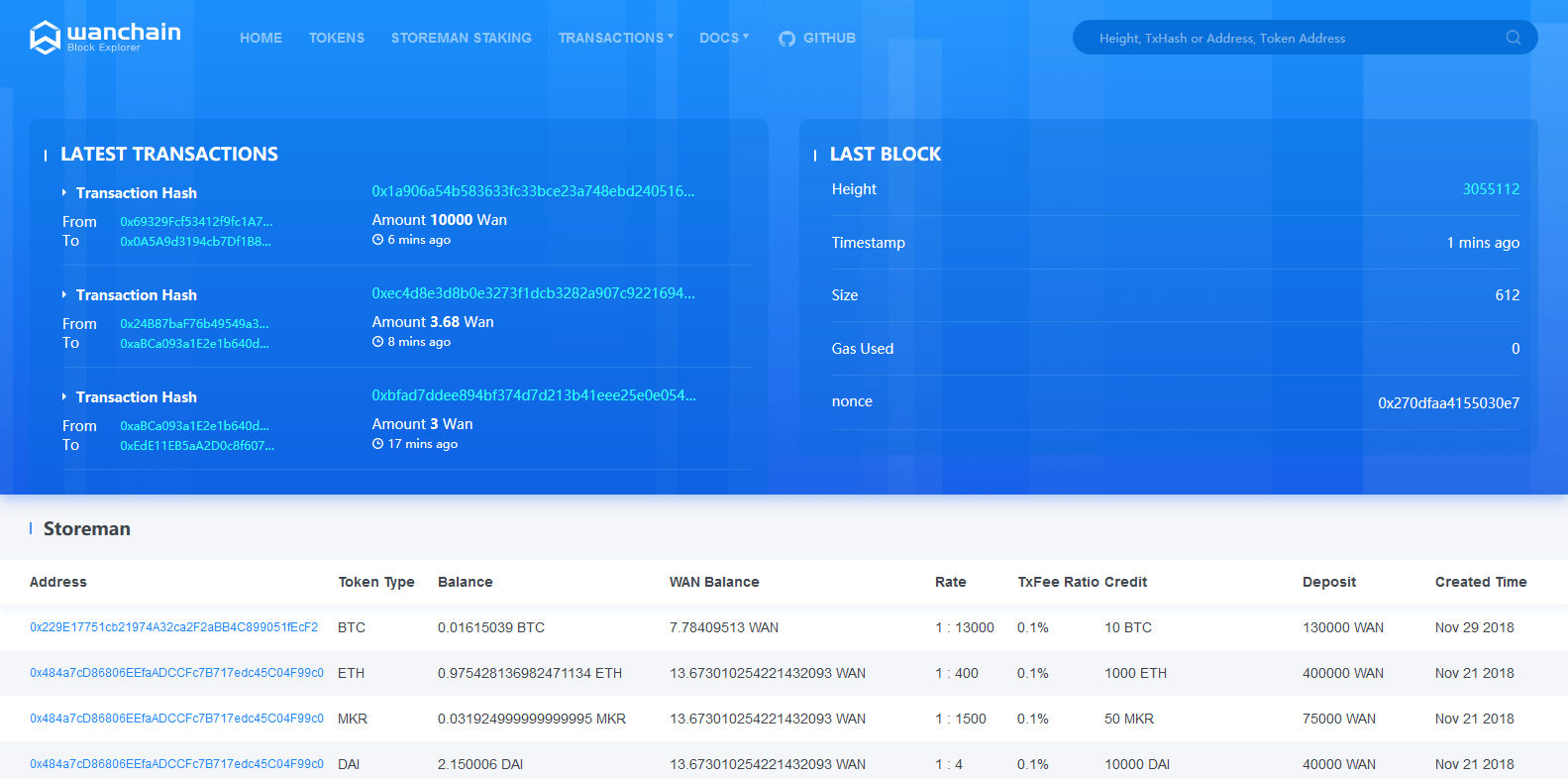

View Screenshots

Token Details

Token Type

Mainnet

Powered by the Wanchain Network. Can be stored on any WAN compatible wallet e.g Official Wallets

Token Statistics

Supply

• Ticker: WAN

• Circulating Supply: 106,152,493

• Total Supply: 210,000,000

• Token Use: Services & Fees

Founders

The Team

• Jack Lu (Founder & CEO)

• Li Ni (V.Pres. Business Dev)

• Oliver Birch (V.Pres. Communications)

• More

Industry

& Competitors

• Blockchain Interoperability

• Fintech Applications

• Competitors – POA, FSN, NIX, etc.