NEP-5 Token

Red Pulse is a market intelligence platform covering China’s financial and capital markets. Our Open Research Platform will connect industry experts, practitioners, and professionals together to share their views and analysis to a global audience. Red Pulse is building the next generation ecosystem for knowledge and research sharing.

Red Pulse introduces a token, PHX, that will power a brand new content production, distribution, and consumption platform focused initially on China’s capital markets. Our vision is to create a direct-incentivization ecosystem facilitated by the PHX token, creating a global community of colleagues.

At the same time, Red Pulse maintains quality by providing editorial oversight of the platform structure, administering a fair and transparent incentivization system, and vetting and approving select research producers as expert-level contributors. PHX helps research consumers and producers be aligned with the increasing demand for China market insights, and thus benefitting from the rise of China’s economy.

- Aggregation – Automated and manual collection of China market news and company specific developments. From hundreds of Chinese language websites, financial statements, and proprietary databases.

- Curation – China research analysts cull irrelevant information, moderate biased viewpoints, and highlight key market, sector, and company-specific developments that can lead to actionable decisions.

- Analysis – Selected market information is methodically assessed for relevancy, and further research and analysis is conducted to explain ultimate impact on markets, sectors, companies, and end investors.

- Production – Analysts and content editors fine-tune the analysis and produce polished output in the form of detailed yet concise chunks of insight, ready to be digested by customers for planning and investment decision making.

“Red Pulse provides a groundbreaking research content platform that simplifies incentives and directly compensates research producers for their valuable insights, while ensuring research consumers can access the research that is most relevant to them. Private portal provides real-time feed and access to 6+ years of archived and tagged research. Research content conveniently categorized into General Macro, Finance, Tech & Internet and Consumer sectors, with an additional 4,000+ tags based on company, ticker, topic and sub-sectors.”

Positives

- Red Pulse is a project that we’ve been following for quite some time. To be honest, a review has been overdue for a while. Red Pulse was one of the first projects to utilize the NEO Blockchain in the way ERC20 tokens utilize the Ethereum blockchain. Red Pulse essentially broke new ground in several ways. With Strategic & Technical Partnerships with Apex, NeonExchange, Onchain and of course NEO to name a few, Red Pulse is a veteran in the “Dapps on NEO” space and will no doubt benefit greatly from NEO’s various, upcoming improvements. We’d like to start off this review by stating that we DO NOT hold any PHX tokens, despite our general liking for this project. It’s one that our Team Members have been following for over a year now.

- Red Pulse is taking full advantage of the extremely fast moving, intense China Markets. Enabling truly decentralized content curation to benefit investors in these markets, Red Pulse is incredibly valuable to those who require a fair resource that is powered by the community behind it. The PHX token on a simple, fundamental level allows the creators of content to be paid whenever a reader wishes to access a piece of content written/curated by that creator. It’s this simple function that allows PHX to be extremely accessible to the average user. There’s no need for the average investor to understand or learn any more than how to use the token, and we think that’s gold when it comes to user engagement and token liquidity. Their platform is fully functional and iOS/Android Apps are readily available to users which is more than a lot of projects can say about their own platforms. Although 2018 has been pretty rough on the price of RPX/PHX, it’s done nothing to stop the progress being made by the Red Pulse Team.

- The recent RPX to PHX token swap has upgraded the fairly simple model behind RPX (detailed in our previous point) to include several other core elements to the platform including; Proof of Creation, Proof of Ownership, Regulatory Compliance, IP Protection and Accountability. Here’s a link if you wish to check these out in detail. We’ve seen community sentiment across various social media channels become more positive with the recent upgrades to the token model and it’s these more advanced elements which will allow for increased longevity of the project and various other opportunities for those looking to use their PHX. Overall a functionally simple token model to the average user with the potential to offer a host of other possibilities. As far as token models go, Red Pulse has this in the bag.

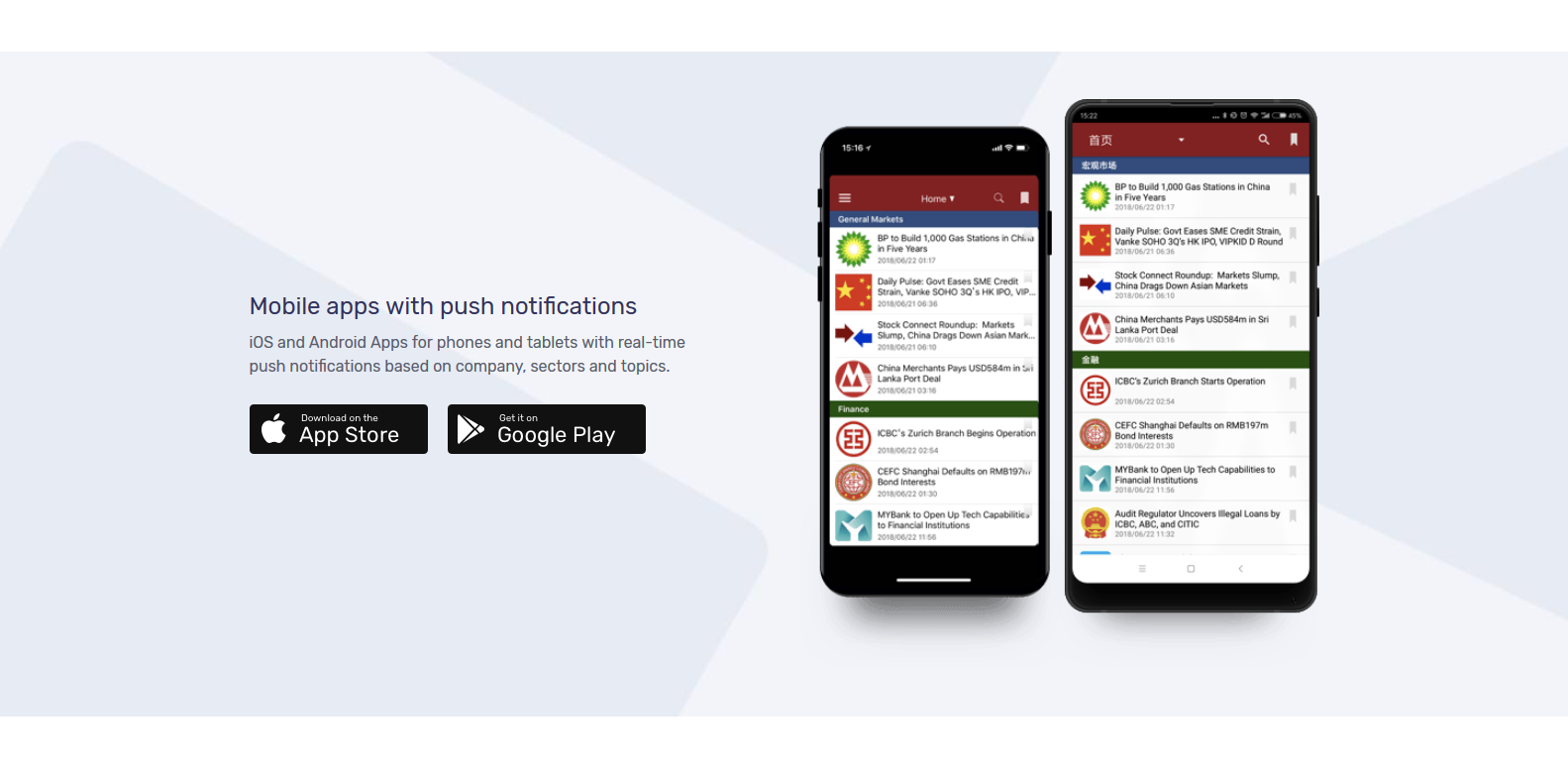

- The Team behind Red Pulse is the perfect example of a well suited Team. The history that some of the members have in China Markets is incredible and has no doubt played a huge part in creating and executing the vision behind Red Pulse. | Jonathan Ha has a prior background in management consulting, having advised major financial institutions on operations and corporate strategy. | Peter Alexander is the Founder and Managing Director of Z-Ben Advisors, a research firm focused on China’s asset management industry. He has 25 years of experience in China financial services and is fluent in both Chinese and English. | Stanley Chao has a prior background in the investment industry in hedge funds, quantitative trading, and alternative investments. Stanley has a Bachelor of Science in Applied and Computational Mathematical Sciences and a Certificate in Computational Finance.

- Red Pulse enables keen investors a way into the previously complex China Markets. Aggregation, Curation, Analysis and Production are all handled within the platform. Hundreds of Chinese websites, Financial Statements, Proprietary Databases are all accessed through Automated & Manual methods which analysts then process to provide users with the competitive edge that they need to understand and react. Red Pulse is extremely beneficial to anybody living outside of Asian countries looking for a foot in the door to their highly reactive markets.

Concerns

- If you’re looking for a big red flag or a major concern regarding Red Pulse, you probably won’t find one. Red Pulse is an excellent example of a pretty low risk investment purely due to the simplicity of the platform. There’s not a whole lot that can go wrong apart from one big inevitability – Competition. This type of “content curation”, “curated analysis” ecocosystem can work really well, but unfortunately unlike a lot of different sectors, it probably won’t benefit from what most would call “healthy competition”. When it comes to the inside scoop, exclusive analysis, hot data, people typically don’t want to have to jump from resource to resource and unless Red Pulse can stay ahead of the competition, they may have to share more of the market than they’d like.

- Red Pulse being solely focused on China Markets gives them a great point of difference from potential competitors. Honing in on one sector specifically no doubt allows for more unique, in-depth analysis. The market specificity is a double-edged sword in a way. Investors benefit from highly targeted content in a specific type of market (China markets in this case) but are essentially limited at the same time. Users of the platform who have interests outside of China Markets have to venture outside of Red Pulse for that information, allowing themselves to be introduced to a platform that might even offer what Red Pulse offers, but a bit more. This is all hypothetical at this point, right now Red Pulse has the ground covered with not much in the way of any serious competition in the space just yet. Something to keep in mind. Not a major concern right now. (It is worth noting that Red Pulse have stated that they’re open to exploring other markets and even completely different sectors in the future.)

- No other concerns here. We’ve seen some FUD around the exact reason for the RPX to PHX token swap but that all seems to be pretty unwarranted and baseless. From all accounts Red Pulse is providing a pretty unique platform and a solution that really benefits from a decentralized component. From what we’ve seen, the platform is pretty organized and free from the usual spam you see in decentralized content platforms such as Steem (albeit a different model entirely). Time will tell whether Red Pulse can continue to bring high quality data to keen investors.

Price Predictions

- Please note: This Price Prediction section was a feature voted on by our community on Twitter. We do not stand by any of the following statements, we are merely speculating. We have been known to be pretty bullish on most projects we review, so take our predictions and DYOR.

- As always, we like to take a step back and look at projects from a purely investment based perspective. PHX has benefited from being listed on top exchanges such as Binance right back when the hottest exchanges were more open to list projects right out of ICO, resulting in plenty of liquidity. On the other hand, PHX has suffered a fair bit more than most other projects in terms of “Price vs All Time High”, but we’ve seen this with a lot mature projects that joined the scene in Mid-2017. Now sitting just under a $25m Market Cap (October 2018), PHX still has a huge amount of growth potential in the long term based on fundamentals. China Markets are typically seen as rather hard to analyse due to the vast amount of sources reporting wildly different sides of the story so to speak, and the lack of accessibility to lets say, somebody in the US. Red Pulse offers it’s users actual value in return for PHX tokens, and that’s a big deal. Now, onto everyone’s favorite, price predictions.

- Short term (< 3 Months) We think PHX could be sitting anywhere from $0.05 to $0.12.

- Mid Term (6 – 12 Months) we think PHX could be a stable $0.20 to $0.40, especially if the market turns around in the next few months.

- Anywhere passed 12 months would be impossible to accurately speculate on but we’d be confident on a $1.00+ PHX in 1+ years. If the All-Time-High of just under $0.80 is anything to go by, $1 could become a pretty stable figure putting the project at just over a $500m Market Cap.

- It’s also worth noting that previous FUD out of China and Asian countries in general has resulted in wild fluctuations in token price for projects based in these areas. Keep an eye on how the government/s of these countries treat Cryptocurrencies in the future. Don’t panic!

View Screenshots

Token Details

Token Type

NEP-5

Powered by the NEO Network. Can be stored on any NEP-5 compatible wallet e.g NeonWallet

Token Statistics

Supply

• Ticker: PHX

• Circulating Supply: 829,588,687

• Total Supply: 1,362,278,592

• Token Use: Services & Fees

Founders

The Team

• Jonathan Ha (Founder & CEO)

• Stanley Chao (Co-founder)

• Peter Alexander (Co-founder)

• More

Industry

& Competitors

• Market Analysis

• Content Curation

• Competitors – Various, No direct.